GRAPHS AND STATISTICS:

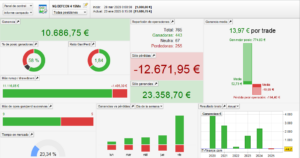

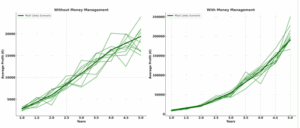

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

DEFCON 4 (color) VS. Nasdaq Index (black) +10686€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT BACKTEST (0.5€/PIP)

DEFCON 4 (color) VS. Nasdaq Index (black) +338243€

DEFCON 4

AUTOMATED STRATEGIC SYSTEM FOR THE NASDAQ 100

1. TECHNICAL OVERVIEW

The DEFCON 4 algorithm is a fully automated, long-only trading system designed for the Nasdaq 100 index (NDX), built on the ProRealTime platform. This system is based on a structurally conservative framework optimized for frequent market engagement while maintaining strict capital preservation mechanisms.

Developed as a modular, adaptive system, DEFCON 4 supports dual configurations: with and without dynamic money management. Its core logic emphasizes high-probability entries, fast break-even protection, and controlled profit extraction through trailing and fixed exits.

Finalized in early 2024, DEFCON 4 inherits structural inspiration from earlier DEFCON frameworks but introduces significant optimization in execution frequency, volatility control, and profit distribution. It is well-suited for traders seeking resilient, high-confidence entries with lower average drawdowns.

2. TECHNICAL SPECIFICATIONS

| Parameter | Specification |

|---|---|

| Algorithm Name | DEFCON 4 |

| Target Market | Nasdaq 100 (US Tech 100 Cash) |

| Position Type | Long-only (no short trades) |

| Timeframe | 15-minute candles |

| Platform | ProRealTime |

| Programming Language | ProBuilder |

| Trading Hours | UTC +1 |

| Trade Frequency | Moderate-High (6–14 trades per week) |

3. STRATEGY PARAMETERS

- Stop Loss: ~1.00%

- Take Profit: ~4.00%

- Break-even Activation: At +0.10%

- Trailing Stop: Enabled, with layered logic

- Entry Conditions: Momentum, breakout filters, volatility gating

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Progressive sizing from 0.5 €/pip based on equity growth (starting from €2,000)

4. PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Max Historical Drawdown | -5.2% | -11.9% |

| Avg. Drawdown per Losing Streak | -2.0% | -3.6% |

| Average Reward-to-Risk Ratio | 4.5:1 | 4.5:1 |

| Win Rate | 70–74% | 70–74% |

| Estimated Annual Return | 18–21% | 60–68% |

| Recovery Factor | 4.1 | 7.2 |

| Estimated Sharpe Ratio | 1.8 | 2.8 |

5. MONTE CARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trade data

Probability of Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 84.5% | 87.1% |

| 2 Years | 89.0% | 91.4% |

| 3 Years | 91.7% | 94.2% |

| 4 Years | 93.3% | 96.0% |

| 5 Years | 94.8% | 97.2% |

Average Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€2,800 | ~€9,100 |

| 2 Years | ~€6,000 | ~€21,000 |

| 3 Years | ~€10,900 | ~€55,000 |

| 4 Years | ~€16,300 | ~€110,000 |

| 5 Years | ~€19,400 | ~€190,000 |

Additional Metrics

| Metric | Without MM | With MM |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -5.0% | -11.2% |

| Standard Deviation of Equity Curves | €3,800 | €208,000 |

6. EXTENDED TECHNICAL CONCLUSION

The DEFCON 4 algorithm represents an evolution of the DEFCON trading logic, refined for greater frequency, improved trade-to-trade reliability, and a stronger defensive posture in volatile environments. Its low stop-to-target ratio, high win rate, and modular structure make it an excellent fit for both intermediate and advanced systematic traders.

The fixed-size mode (without money management) caters to traders with capital restrictions, regulatory constraints (such as prop firms), or preference for smooth equity curves. This configuration still achieves meaningful compounding through consistent win rates and a strong reward-to-risk profile.

In money-managed mode, DEFCON 4 scales via dynamic pip sizing. The result is a more realistic yet still aggressive capital expansion path, with €190,000 projected after five years from just €2,000 initial capital. Monte Carlo simulations confirm long-term profitability even under random equity sequence stress.

What further distinguishes DEFCON 4 is its high trade frequency and hit rate, which buffer it against volatility clusters and stagnation. Stress tests across trade sequences and volatility conditions confirm its statistical resilience.

➤ Designed for:

- Traders seeking balance between consistency and growth

- Both passive and compound equity strategies

- High win rate and frequent engagement

- Long-term systematic resilience and performance

- Modular integration in diversified portfolios

ENDIF

DEFCON 4 WITH MM

DEFCON 4 WITH MM

Reviews

There are no reviews yet.