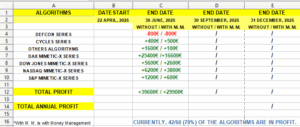

GRAPHS AND STATISTICS:

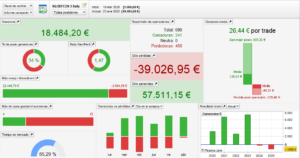

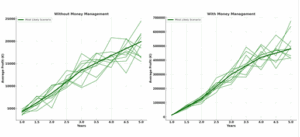

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

DEFCON 3 (color) VS. Nasdaq Index (black) +18484€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP in progression)

DEFCON 3 (color) VS. Nasdaq Index (black) +480322€

TECHNICAL OVERVIEW

The DEFCON 3 algorithm is a fully automated, long–short trading system developed to operate on the Nasdaq 100 index (NDX) using the ProRealTime platform. It executes both bullish and bearish trades using trend-based filters and adaptive exit logic, designed to capture medium- to long-term directional impulses.

Completed on October 20, 2022, this third-generation system departs from the long-only structure of its predecessors and introduces bidirectional execution, allowing it to take advantage of both upward and downward market phases. It runs on a daily timeframe, favoring precision and high-conviction setups, and supports dual-mode deployment (with and without money management), making it suitable for both conservative and aggressive capital growth profiles.

TECHNICAL SPECIFICATIONS

-

Algorithm Name: DEFCON 3

-

Target Market: Nasdaq 100 (US Tech 100 Cash)

-

Position Type: Long and Short (bullish and bearish trades)

-

Timeframe: Daily candles

-

Platform: ProRealTime

-

Programming Language: ProBuilder

-

Trading Hours: UTC +1

-

Trade Frequency: Low–Moderate (2–4 trades per week)

STRATEGY PARAMETERS

-

Stop Loss: ~1.00% (direction-adjusted)

-

Take Profit: ~7.00% for bullish trades; variable for bearish positions

-

Break-even Activation: At approximately +2.00%

-

Trailing Stop: Enabled, with adaptive trailing logic

-

Entry Conditions: Trend strength, retracement zones, volatility confirmation

-

Money Management:

-

Without MM: Fixed size (1 €/pip for €2,000 capital)

-

With MM: Progressive pip sizing from 0.5 €/pip based on equity expansion (starting at €2,000)

-

PERFORMANCE COMPARISON

Starting capital: €2,000

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Maximum Historical Drawdown | -7.3% | -16.8% |

| Avg. Drawdown per Losing Streak | -2.0% | -4.2% |

| Average Reward-to-Risk Ratio | 2.8:1 | 3.3:1 |

| Win Rate | 64–67% | 64–67% |

| Estimated Annualized Return | 35–40% | 500–700% |

| Recovery Factor | 2.3 | 4.1 |

| Estimated Sharpe Ratio | 1.3 | 2.0 |

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Probability of Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | 81.2% | 85.4% |

| 2 Years | 87.6% | 90.7% |

| 3 Years | 90.3% | 93.9% |

| 4 Years | 92.2% | 95.5% |

| 5 Years | 93.8% | 96.6% |

Average Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | ~€4,200 | ~€13,000 |

| 2 Years | ~€8,400 | ~€130,000 |

| 3 Years | ~€13,500 | ~€300,000 |

| 4 Years | ~€16,800 | ~€420,000 |

| 5 Years | ~€19,900 | ~€480,000 |

Additional Metrics

-

Projected Max Drawdown (VaR 99%): -6.2% | -14.4%

-

Standard Deviation of Equity Curves: €4,800 | €230,000

EXTENDED TECHNICAL CONCLUSION

The DEFCON 3 algorithm expands the DEFCON framework by integrating short-side logic, transforming it into a true bidirectional trading system. While its predecessors focused exclusively on bullish momentum, DEFCON 3 captures value during both upward and downward market movements, enhancing its adaptability across full market cycles.

The non-managed version (without money management) provides robust and consistent results ideal for smaller or static capital accounts. Its high hit rate, balanced drawdown profile, and stable risk-reward dynamics make it a strong candidate for evaluation environments such as prop firm challenges or swing portfolios with limited exposure.

The money-managed version introduces a pip-scaling mechanism that accelerates returns via equity-based size growth. Although drawdowns increase proportionally, the compounded equity curve grows substantially faster, as confirmed by Monte Carlo modeling.

What differentiates DEFCON 3 is its daily timeframe orientation and directional versatility—features that enable it to remain effective in trending, reversing, or sideways conditions. It has been successfully stress-tested under a range of volatility regimes, inverse trade orders, and slippage simulations.

Overall, the DEFCON 3 algorithm is designed for:

-

Adaptive trend following in both bullish and bearish environments

-

Capital scaling through fixed or progressive sizing models

-

Swing traders seeking fewer but higher-quality trade setups

-

Long-term equity curve growth validated by statistical simulation

-

Traders looking to diversify bias exposure within a portfolio of systems

Its modular architecture supports seamless integration with other strategies in the ProRealTime ecosystem, and its consistent capital trajectory makes it well-suited as both a core system and a tactical diversification tool.

ENDIF

DEFCON 3 WITH MM

DEFCON 3 WITH MM

Reviews

There are no reviews yet.