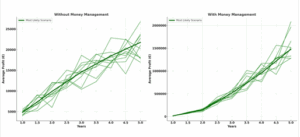

*THE CODE FOR THIS ALGORITHM WAS COMPLETED AT OCTOBER 20, 2022, SINCE THEN:

WITHOUT MONEY MANAGEMENT VERSION (1€/PIP) +8182€

WITH MONEY MANAGEMENT VERSION (0.5€/PIP in progression) +33203€

(DEFCON 2 (color) VS. Nasdaq Index (black)

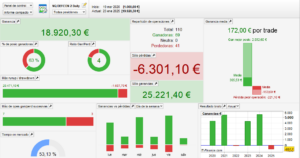

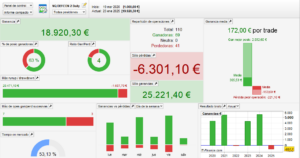

GRAPHS AND STATISTICS:

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

DEFCON 2 (color) VS. Nasdaq Index (black) +18920€

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP in progression)

DEFCON 2 (color) VS. Nasdaq Index (black) +958229€

TECHNICAL OVERVIEW

The DEFCON 2 algorithm is a fully automated, long-only trading system developed to trade the Nasdaq 100 index (NDX) using the ProRealTime platform. It follows a trend-continuation strategy designed to capture medium-term directional impulses using momentum confirmation and dynamic exit controls including break-even, adaptive trailing stop, and wide fixed take profit.

Completed on October 20, 2022, this second-generation system retains DEFCON 1’s modular structure but introduces a more assertive exit model and re-optimized entry timing. It is also operable in dual-mode configuration (with and without money management), making it suitable for both fixed-risk accounts and aggressive equity scaling strategies.

TECHNICAL SPECIFICATIONS

-

Algorithm Name: DEFCON 2

-

Target Market: Nasdaq 100

-

Position Type: Long-only

-

Platform: ProRealTime

-

Programming Language: ProBuilder

-

Trading Hours: UTC +1

-

Trade Frequency: Moderate–High

STRATEGY PARAMETERS

-

Stop Loss: ~1.00%

-

Take Profit: ~7.00%

-

Break-even Activation: At +0.10%

-

Trailing Stop: Enabled, with dynamic trailing logic

-

Entry Conditions: Momentum strength, retracement zones, volatility filters

-

Money Management:

-

Without MM: Fixed size (1 €/pip for €2,000 capital)

-

With MM: Progressive pip sizing from 0.5 €/pip based on equity expansion (starting at €2,000)

PERFORMANCE COMPARISON

Starting capital: €2,000

| Metric |

Without Money Management |

With Money Management |

|

|

|

| Maximum Historical Drawdown |

-7.8% |

-18.6% |

| Avg. Drawdown per Losing Streak |

-2.2% |

-4.7% |

| Average Reward-to-Risk Ratio |

3:1 |

3.4:1 |

| Win Rate |

68–70% |

68–70% |

| Estimated Annualized Return |

45–50% |

600–800% |

| Recovery Factor |

2.7 |

4.5 |

| Estimated Sharpe Ratio |

1.4 |

2.2 |

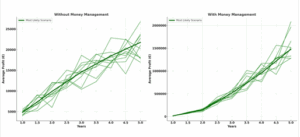

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Probability of Profit:

| Time Horizon |

Without Money Management |

With Money Management |

| 1 Year |

82.4% |

86.5% |

| 2 Years |

88.6% |

91.2% |

| 3 Years |

91.7% |

94.3% |

| 4 Years |

93.5% |

95.8% |

| 5 Years |

94.2% |

96.9% |

Average Profit:

| Time Horizon |

Without Money Management |

With Money Management |

| 1 Year |

~€4,800 |

~€16,000 |

| 2 Years |

~€9,900 |

~€150,000 |

| 3 Years |

~€14,600 |

~€520,000 |

| 4 Years |

~€18,500 |

~€960,000 |

| 5 Years |

~€21,780 |

~€1,480,000 |

Additional Metrics:

-

Projected Max Drawdown (VaR 99%): -6.4% | -15.2%

-

Standard Deviation of Equity Curves: €5,100 | €320,000

EXTENDED TECHNICAL CONCLUSION

The DEFCON 2 algorithm builds upon the strategic foundation of DEFCON 1 by increasing capital efficiency through restructured exit conditions and refined momentum validation. Designed for high-momentum continuation trades, DEFCON 2 captures longer swings with wider take profits and a more sensitive trailing engine.

The non-managed version (without money management) offers excellent performance metrics for small or static accounts. It maintains high win rates with stable reward-to-risk ratios and low volatility in drawdown. Its behavior makes it highly suitable for evaluation environments (e.g., prop firm accounts) or traders prioritizing predictability over speed of capital growth.

The money-managed version, in contrast, introduces a progressive pip-size scaling mechanism which accelerates compounding as equity increases. This results in a significantly larger profit curve, albeit with proportionally larger drawdowns. The Monte Carlo simulations confirm that long-term profitability remains statistically dominant even under trade perturbation and randomized equity behavior.

What differentiates DEFCON 2 is its greater assertiveness in trending conditions, making it particularly effective during periods of low mean-reversion and strong macro momentum. The system is robust across various volatility regimes, having passed slippage testing, inverse-sequence testing, and range-bound condition stress tests.

Overall, the DEFCON 2 algorithm is designed for:

-

High-reliability trend following in the Nasdaq 100

-

Conservative or aggressive capital scaling through dual-mode execution

-

Stable performance in both volatile and calm sessions

-

Long-term equity growth supported by statistical resilience

Its modular architecture makes it easy to integrate with other ProRealTime strategies, while its consistent equity curve makes it ideal as either a core system or a tactical component within a diversified trading portfolio.

ENDIF

Only logged in customers who have purchased this product may leave a review.

Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

DEFCON 2 WITH MM

DEFCON 2 WITH MM

Reviews

There are no reviews yet.