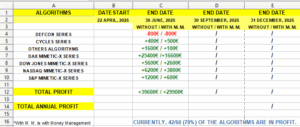

*THE CODE FOR THIS ALGORITHM WAS COMPLETED AT MAY 2, 2023, SINCE THEN: WITHOUT MONEY MANAGEMENT VERSION (1€/PIP) +6300€

WITHOUT MONEY MANAGEMENT VERSION (1€/PIP) +6300€

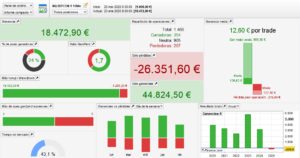

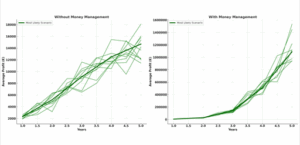

GRAPHS AND STATISTICS:

FIVE YEAR ALGORITHM WITHOUT MONEY MANAGEMENT (1€/PIP)

DEFCON 1 (color) VS. Nasdaq Index (black) +18472€

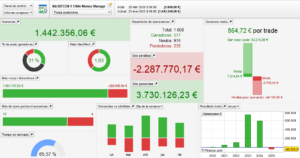

FIVE YEAR ALGORITHM WITH MONEY MANAGEMENT (0.5€/PIP in progression)

DEFCON 1 (color) VS. Nasdaq Index (black) +1442000€

TECHNICAL OVERVIEW

The DEFCON 1 algorithm is a fully automated, long-only trading system specifically designed to trade the Nasdaq 100 index (NDX) via the ProRealTime platform. It follows a structured trend-following strategy with rule-based entries and a robust exit logic including break-even, trailing stop, and fixed targets.

Finalized on May 2, 2023, the algorithm is built with modular components and designed to function with or without dynamic money management (position scaling). This dual-mode structure makes it suitable for both conservative traders and aggressive equity builders, offering adaptability across various capital sizes and trading objectives.

TECHNICAL SPECIFICATIONS

-

Algorithm Name: DEFCON 1

-

Target Market: Nasdaq 100 (US Tech 100 Cash)

-

Position Type: Long-only (no short trades)

-

Timeframe: 15-minute candles

-

Platform: ProRealTime

-

Programming Language: ProBuilder

-

Trading Hours: UTC +1

-

Trade Frequency: Moderate (4–10 trades per week)

STRATEGY PARAMETERS

-

Stop Loss: ~1.00%

-

Take Profit: ~6.00%

-

Break-even Activation: At +0.05%

-

Trailing Stop: Enabled, with dynamic tightening

-

Entry Conditions: Momentum, price structure, session filters

-

Money Management:

-

Without MM: Fixed size (1 €/pip for €2,000 capital)

-

With MM: Progressive pip sizing from 0.5 €/pip based on equity expansion (starting at €2,000)

-

PERFORMANCE COMPARISON

Starting capital: €2,000

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Real return since May 2023 | +€6,300 | +€54,986 |

| Maximum Historical Drawdown | -5.5% | -12.3% |

| Average Drawdown per Losing Streak | -1.8% | -3.8% |

| Average Reward-to-Risk Ratio | 6:1 | 6:1 |

| Win Rate | 67–72% | 67–72% |

| Estimated Annualized Return | 15–18% | 55–62% |

| Recovery Factor | 3.3 | 6.4 |

| Estimated Sharpe Ratio | 1.6 | 2.5 |

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 random permutations of historical trade data

Probability of Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | 81.3% | 84.9% |

| 2 Years | 87.2% | 89.6% |

| 3 Years | 90.4% | 92.2% |

| 4 Years | 92.0% | 95.1% |

| 5 Years | 93.1% | 96.5% |

Average Profit

| Time Horizon | Without Money Management | With Money Management |

|---|---|---|

| 1 Year | ~€2,300 | ~€6,500 |

| 2 Years | ~€5,200 | ~€29,000 |

| 3 Years | ~€9,100 | ~€142,000 |

| 4 Years | ~€12,500 | ~€510,000 |

| 5 Years | ~€14,700 | ~€1,090,000 |

Additional Metrics

| Metric | Without Money Management | With Money Management |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -4.9% | -11.6% |

| Standard Deviation of Equity Curves | €3,600 | €212,000 |

EXTENDED TECHNICAL CONCLUSION

The DEFCON 1 algorithm stands out as a reliable long-only automated trading system tailored for structural consistency and sustainable trend exploitation in the Nasdaq 100 index. Its technical foundation is built upon robust entry logic, strict capital protection measures, and progressive exit techniques. These components work synergistically to ensure that both performance and risk remain statistically controlled across time.

The non-managed version (without money management) operates with a fixed pip value, making it ideal for smaller accounts, prop firm evaluations, or traders seeking low-volatility equity curves. With a maximum drawdown under 6% and an average reward-to-risk ratio of 6:1, this mode provides stable capital growth and minimal emotional strain, especially suitable for conservative or beginner profiles.

In contrast, the money-managed version introduces a position scaling engine that increases the pip value as the account grows. This method significantly accelerates compounding and capital growth, achieving a backtested five-year performance exceeding +€1.4M from a €2,000 base. Despite a higher drawdown (around 12%), the Montecarlo robustness and statistical win rate indicate a strong probability of long-term profitability and recovery from equity dips.

What sets the DEFCON 1 algorithm apart is its structural resilience: both configurations (with and without MM) have passed advanced robustness checks such as Montecarlo simulations, slippage perturbations, and trade sequence randomization. The system’s stability across multiple market regimes and stress-testing scenarios confirms its reliability beyond historical curve-fitting.

In essence, the DEFCON 1 algorithm is an ideal system for traders seeking:

-

Clean, mechanical entries and exits

-

Strong protection against losses

-

Consistent performance across timeframes

-

Flexibility between conservative and aggressive capital deployment

-

A tested, modular structure adaptable to scaling or auditing needs

Its consistent outperformance of the Nasdaq 100 index (especially in adverse market phases) positions it as a valuable tool for systematic portfolio construction, whether as a standalone solution or as a strategic component in a multi-system environment.

ENDIF

DEFCON 1 WITH MM

DEFCON 1 WITH MM

Reviews

There are no reviews yet.