Bollinger bubbles, or Tradobubbles (from the well-known french Tradosaure), are candles that are fully outside the Bollinger bands, without any contact with them, even the wicks.

Whether a bubble is above or below the Bollinger Bands, this configuration indicates an excessive price movement. Finding bollinger bubbles can allow you to follow the correction (upwards or downwards) of this excessive movement.

Two screeners are included in this product:

- Screener “all TimeFrame”

- Screener multi TimeFrame

The “all TF” screener scans the stock market for bollinger bubbles, in the timeframe you have defined in the screener drop down menu. Results are then sorted according to the position of the detected bubble.

The Multi TF screener scans up to 9 timeframes simultaneously (regardless of the TF in the screener drop-down menu): 5‘ / 10’ / 15‘ / 30’ / 1h / 2h / 4h / Day / Weekly. The results are sorted according to timeframe and position of the bubble.

In both screeners, a general filtering, in daily TF, based on the stock price and trading volumes, allows you to fix the minimum level of liquidity required.

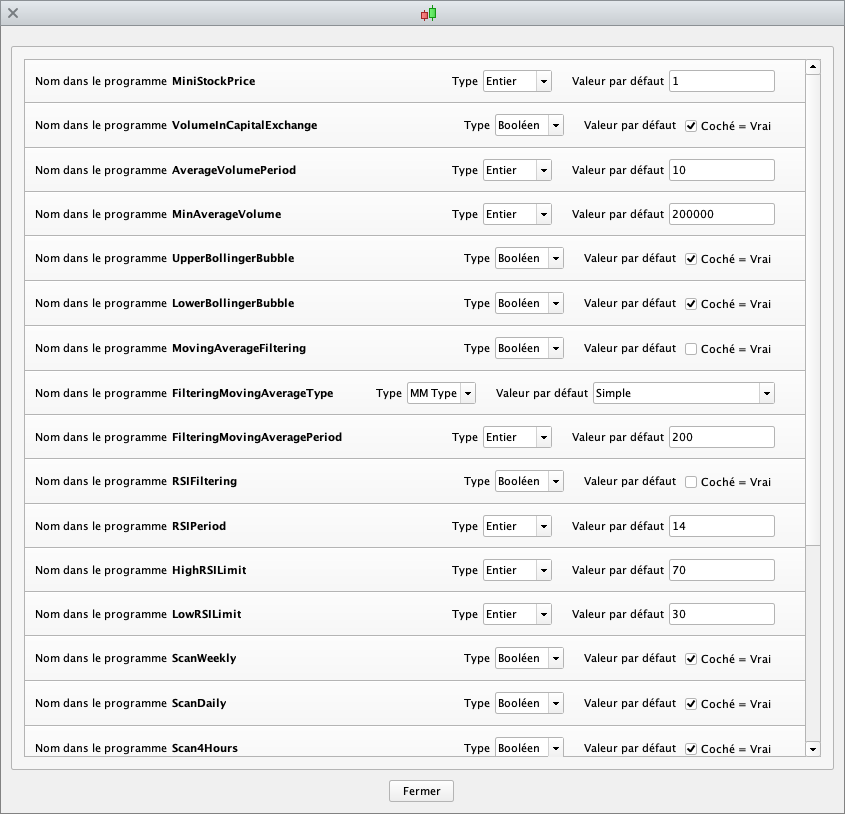

Many parameters and filters can be adjusted to detect the Bollingers Bubbles that meet your criteria. These settings are made without modifying the code, in the ‘variables’ menu of the screeners:

Adjustable validation criteria :

- Upper Bubbles

- Lower Bubbles

- Period and standard deviation for the bollinger bands

Available filters :

- Price position relative to moving average

- Filtering moving average period and type

- RSI filtering

- RSI filtering period

- High and Low RSI filtering threshold

- TF to be scanned activation (multiTF screener)

General filter :

- Minimum stock price

- Minimum average volume

- Average volume expressed in transaction number or in capital exchange

Characteristics :

- Works on all TimeFrames

- ProRealTime V11 and later versions compatible

- Free ProRealTime (daily closings) compatible

- Automatic and free updates

Watch the video user’s guide on our Youtube channel, subtitles available in English :

Reviews

There are no reviews yet.