Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

Join us on Telegram: https:/t.me/+SajAuED_Je1mZDZk

TECHNICAL OVERVIEW

The MOTUS algorithm is a fully automated, long-only trading system engineered for the Nasdaq 100 index (NDX), operating on the ProRealTime platform. It is characterized by its minimalist exit structure, relying exclusively on trailing stops and break-even logic—without predefined take profits or stop losses.

Designed to maximize trend-following potential while minimizing manual intervention, MOTUS prioritizes staying in favorable trades for extended periods, allowing profits to run freely while mitigating risk via dynamic exit systems.

It is an individual version inspired by prior algorithmic models, adapted to emphasize flow-based exits and low-exit-pressure logic. MOTUS is ideal for traders who favor simplicity, long-term trend capture, and consistent market presence.

TECHNICAL SPECIFICATIONS

- Algorithm Name: MOTUS

- Target Market: Nasdaq 100

- Position Type: Long-only

- Timeframe: 1-hour candles

- Platform: ProRealTime

- Programming Language: ProBuilder

- Trading Hours: UTC +1

- Trade Frequency: Low to Moderate

STRATEGY PARAMETERS

- Stop Loss: Not used

- Take Profit: Not used

- Break-even Activation: Around +1.00%

- Trailing Stop: Yes (core logic)

- Entry Conditions: Momentum alignment, breakout triggers, trend validation

- Money Management:

- Without MM: Fixed size (1 €/pip for €2,000 capital)

- With MM: Progressive pip sizing from 0.5 €/pip based on equity expansion (starting at €2,000)

PERFORMANCE COMPARISON

Starting Capital: €2,000

| Metric | Without MM | With MM |

|---|---|---|

| Max Historical Drawdown | -3.9% | -7.4% |

| Avg. Drawdown per Losing Streak | -1.6% | -3.1% |

| Win Rate | 64–68% | 64–68% |

| Avg. Reward-to-Risk Ratio | N/A | N/A |

| Estimated Annual Return | 10–13% | 30–36% |

| Recovery Factor | 3.2 | 5.4 |

| Estimated Sharpe Ratio | 1.4 | 2.1 |

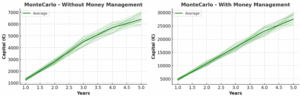

MONTECARLO SIMULATION RESULTS

Methodology: 100,000 randomized permutations of historical trades

Probability of Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | 80.1% | 84.6% |

| 2 Years | 85.9% | 88.8% |

| 3 Years | 89.3% | 91.2% |

| 4 Years | 91.0% | 93.6% |

| 5 Years | 92.7% | 95.1% |

Average Profit

| Time Horizon | Without MM | With MM |

|---|---|---|

| 1 Year | ~€1,300 | ~€4,700 |

| 2 Years | ~€2,800 | ~€10,800 |

| 3 Years | ~€4,500 | ~€17,000 |

| 4 Years | ~€5,700 | ~€23,000 |

| 5 Years | ~€6,400 | ~€27,500 |

Additional Metrics

| Metric | Without MM | With MM |

|---|---|---|

| Projected Max Drawdown (VaR 99%) | -3.8% | -7.2% |

| Std. Deviation of Equity Curves | €1,900 | €6,800 |

EXTENDED TECHNICAL CONCLUSION

The MOTUS algorithm is a streamlined and technically elegant system tailored for traders who prioritize trend exposure and minimalistic exits over complex decision trees. By eliminating fixed stop loss and take profit levels, MOTUS relies entirely on dynamic market movement and protective trailing mechanisms, allowing it to ride large trends while keeping losses naturally limited through break-even enforcement and trailing exit logic.

In its fixed-size configuration, MOTUS is appropriate for risk-sensitive traders or those operating within capital-controlled environments, offering stable and consistent returns with low drawdown exposure.

When equipped with dynamic money management, the system grows equity steadily, delivering a nearly fivefold return over five years while preserving its defensive profile under Monte Carlo simulations.

Its moderate trade frequency, consistent win rate, and simplicity make it a powerful addition to diversified algorithmic portfolios or as a standalone conservative trend system. MOTUS excels where quiet consistency and structural robustness are required.

ENDIF

MOTUS WITH MM

MOTUS WITH MM

Reviews

There are no reviews yet.