NASDAQ “ALPHA PREDATOR”+.

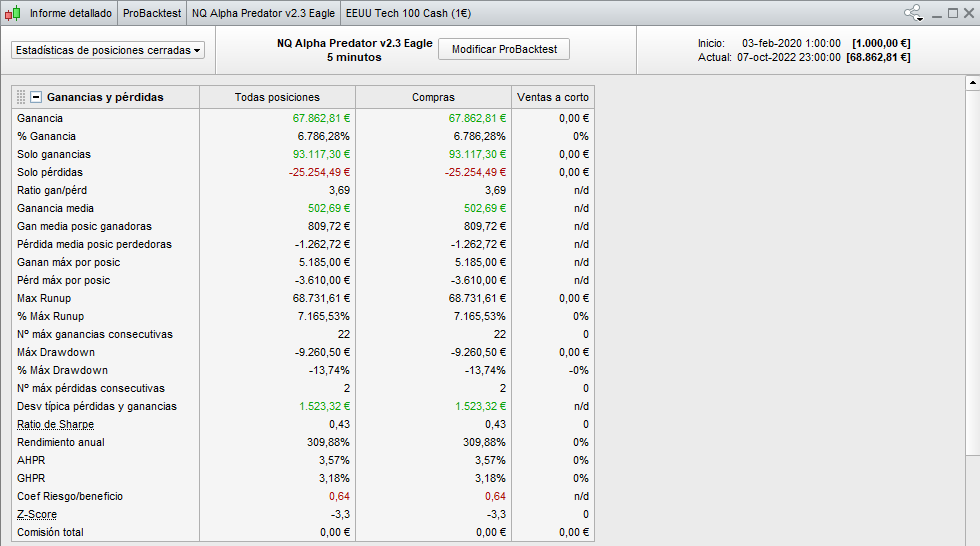

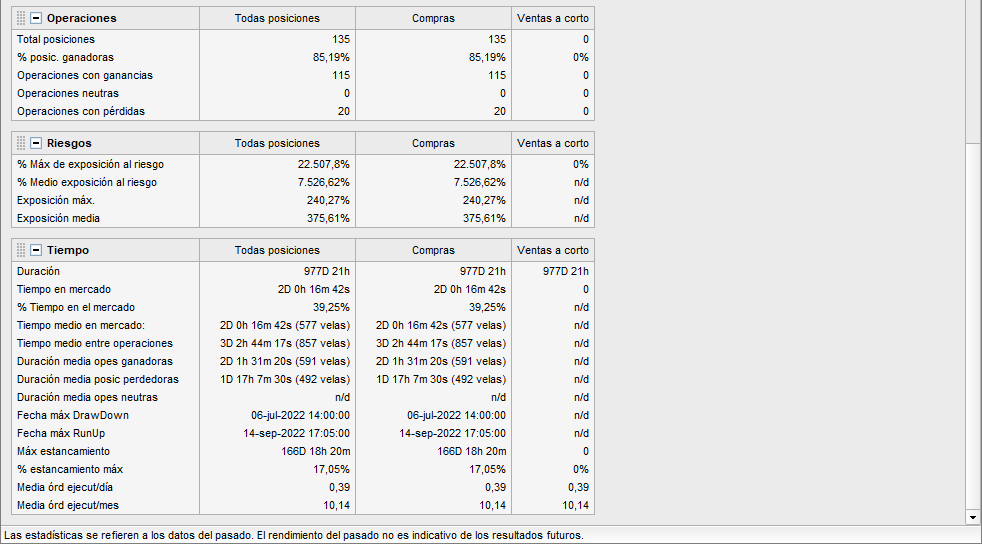

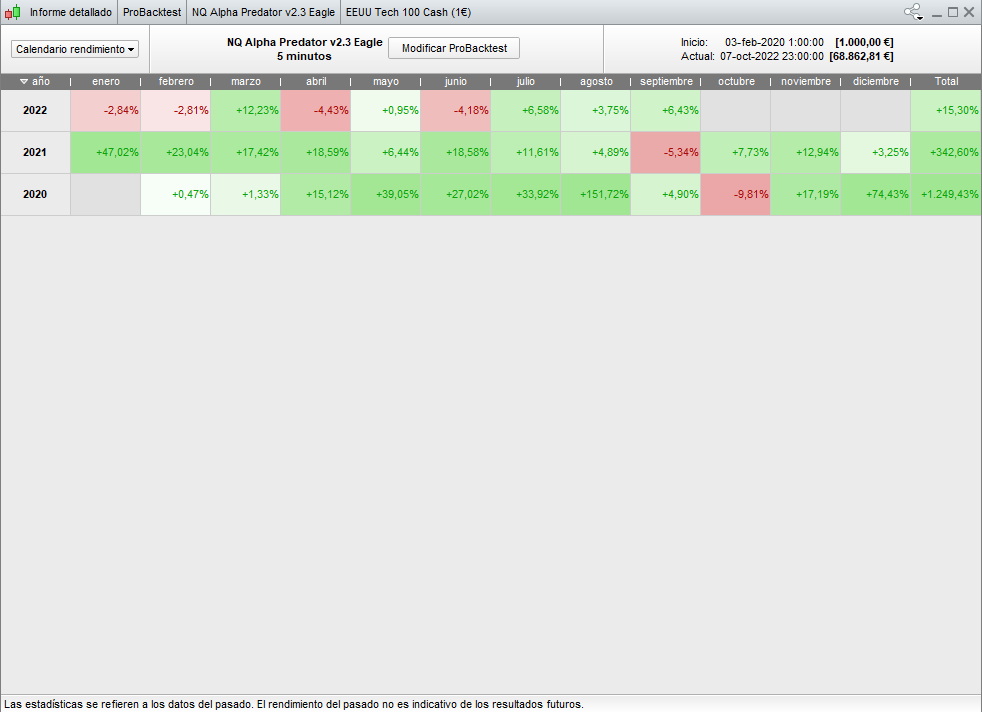

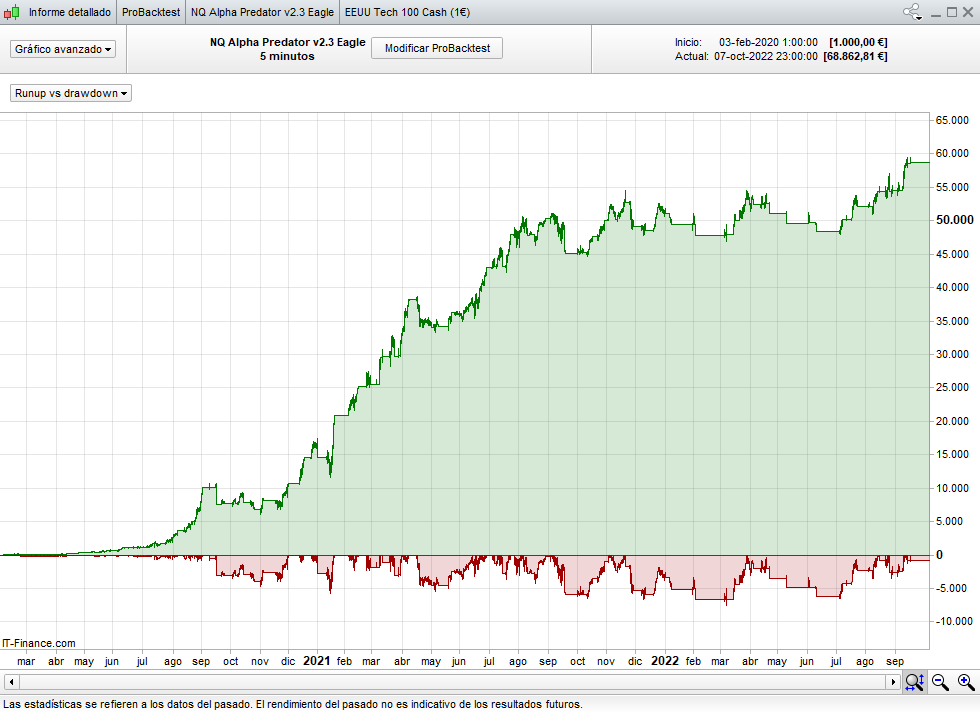

General pre-MarketPlace Backtest:

*Results of the “EAGLE” version.

Results from available in the MarketPlace:

29 October 2021 to January 2023, with/without Money Management (spread 1.5).

*Results of the “EAGLE” version.

-Result conclusions:

The bot obtains a detriment as of today, in bot versions with/without Money Management.

Version with Money Management -436€ balance.

Version without Money Management -1181€ balance.

-Result reasons:

The bot is exclusively bullish, it only trades long positions.

Precisely by including it in the MarketPlace begins a long and deep technical correction in the index that continues today, with a drop in the Nasdaq Index of practically 40% from its ATH.

-Result explanations:

Also, from the beginning, we urge you that perhaps you should activate the versions with Money Management, where the detriment, if any, will be less, and the benefit, if any, will be greater.

*Users receive an email when renting our bull bots (Nasdaq “Predator”+, Nasdaq “Ignition!”+, and “Nexus”+ series bots), explaining that IT MAY NOT BE THE RIGHT TIME TO ACTIVATE THEM DUE TO THE CORRECTION TECHNIQUE, and can activate them in real or demo mode, observe and study their statistics for a very low price.

- SPECIFICATIONS:

- Broker: ProRealTime Platform or Broker with ProRealTime.

- Active: Nasdaq 100 (1€ CFDS).

- Conceptual programming base of bot: Measurement and analysis of trend strength through intraday and short-term moving averages.

- Type: Trend.

- Style: Day Trading, Swing, Short Term.

- Operations: Long only (Bull bot).

- Term: 5 minutes.

- Operating hours: 00:00 to 24:00.

- Coordinated Universal Time: Your platform MUST be set to Europe/Paris (currently, no summer time, it should be set to UTC +1).

- Accumulate positions: No.

- Money Management: Yes / No, you can choose by editing the code.

- Min/Max Size: € 0.5/ € 10, for all r/b ratio versions (Min size € 0.5 or € 1, according to broker account)*.

- Take profit: Greater than 3%.

- Receiving losses: Less than 3%.

- Breakeven: Less than 1.5%.

- Trailing stop: Yes.

- Partial clousures: No.

- CAPITAL NEEDED:

We recommend a minimum of € 2000 for each activated bot WITH money management, and a minimum of € 4000 for each activated bot WITHOUT money management (Margins and first risks of the operation included).

Note that the bot WITH money management starts trading at € 0.5 pip size and in progression / regression, and the bot WITHOUT money management always trades at € 1 pip size.

YOU NEVER NEED TO INCREASE ADDITIONAL CAPITAL TO THE INITIAL CONTRIBUTION, THE BOT WITH MONEY MANAGEMENT FEEDBACKS THE NECESSARY MARGIN FOR SUBSEQUENT OPERATIONS WITH THE BENEFIT OF PREVIOUS OPERATIONS.

- MARKET ENTRY:

-It has three trend filters, two of them intraday, and a third short-term.

Only when the three filters coincide in a coordinated position, and determined, the entry to the market will be effective, thus seeking the strength of the uptrend.

-Market entry will only be effective if the three trend filters mentioned above coincide, in turn, with the trading hours with the highest historical volume, thus also looking for the best moment.

- SECURITY MEASURES (Drawdown control):

In addition to breakeven, taking profit and stopping losses, bots have other parameters to close trades.

-They only allow an operation with daily losses, the bot will stop operating for the rest of the day, in the event of a possible intraday or short-term correction in the asset.

-They only allow a daily loss less than 0.5% on the free float, the bot will stop operating for the rest of the day.

-They only allow a month loss less than 2.5% on the total capital accumulated that month, the bot will stop operating for the rest of the actual month, before a possible short or medium-term correction in the asset.

- SECURITY MEASURES (Risk control):

-The operations with little activity (“Sleepers”), are closed automatically after a period of no less than five days and no more than ten days.

-The operations detected as potentially dangerous, close at a specific time on Friday (Bye Monday Gap).

- STRESS TESTS:

The bots, and their backtests, have been subjected to research & development, and subsequently to a variety of stress tests on their results for more than two years, to achieve a RELIABLE, EFFICIENT, ACCURATE, ROBUST, AND PROFITABLE product.

The important goal of these progression / regression sequences is to minimize drawdown, and also put the bot through a tough test of its stats’ strength and endurance.

(MINIMIZE RISKS – MAXIMIZE PROFITS).

Analyze our product, BE PATIENT, BE CONSTANT, let the bots develop in time.

You must bear in mind that our products with money management begin operating with a minimum investment. Once the strategy produce some profits, position size will gradually increase protecting your initial capital and maximize the benefits.

- PRODUCT RECEIVED BY USER:

You get Nasdaq “ALPHA PREDATOR”+, with money management, and Nasdaq “ALPHA PREDATOR”+ without money management.

- LATER UPDATES:

-UPDATE OF 07-06-22, we introduce in the code the “Fast Parameters Selector” module.

-UPDATE OF 05-11-22, we introduce a new medium term trend selection tool, and a new money management tool… now is ready for medium term price and time corrections!.