The Central Pivot Range screener is a powerful tool to scan the market for specific two-periods CPR relation to spot high probabilities trading opportunities.

The pack contains the screeners for the daily CPR relation, which is suitable especially for day-traders.

It is suggested to be used along with the Daily CPR plotted on minor timeframes charts such as 1 up to 15 minutes.

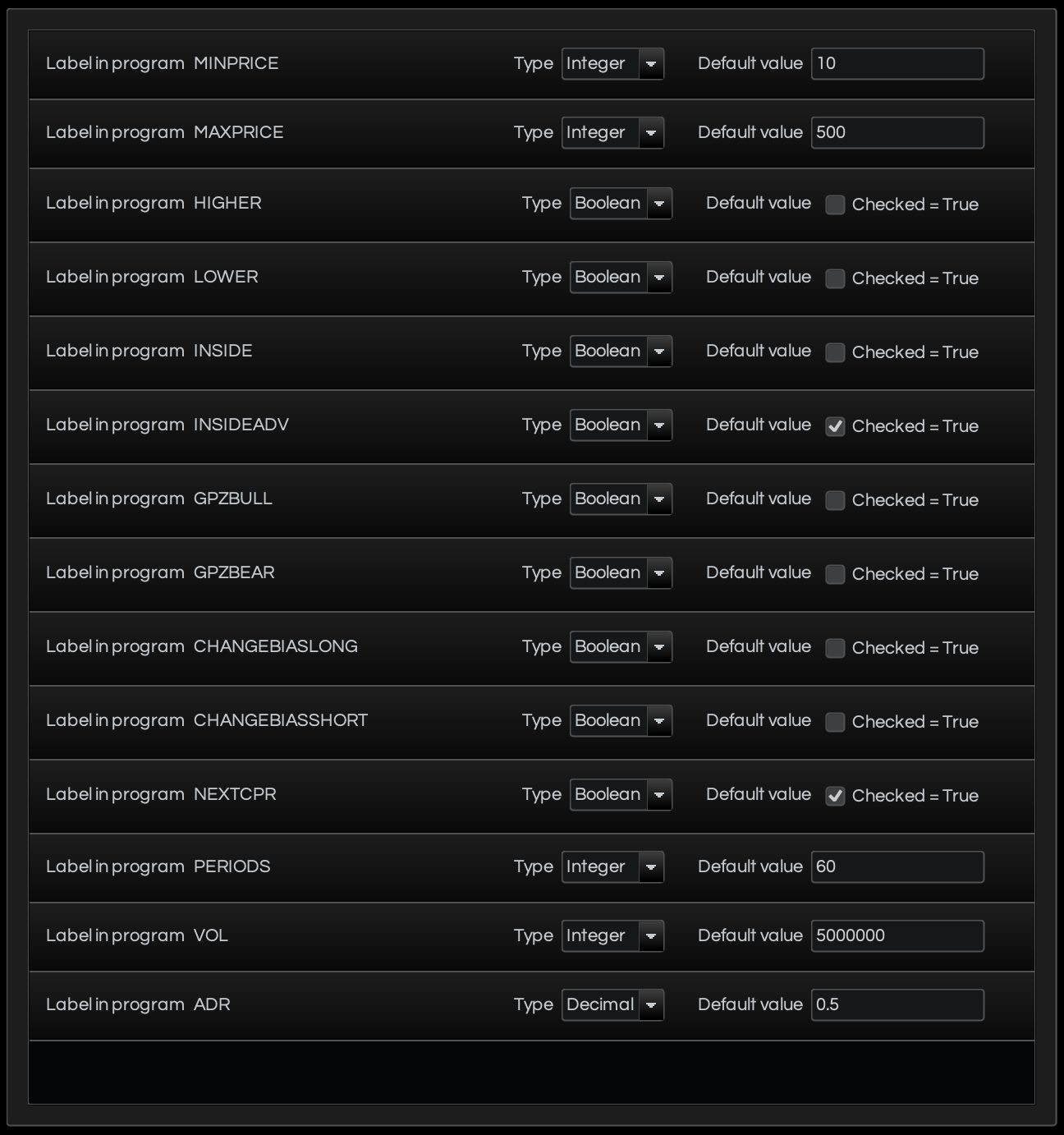

The screener allows you to scan the market given specific criteria such as:

- Stock price MIN PRICE: set the minimum price of the assets you want to filter

- Stock price MAX PRICE: set the maximum price of the assets you want to filter

- HIGHER: flag this field if you want to scan for long opportunities in the upcoming session. Look for entering the market long at CPR pullback.

- LOWER: flag this field if you want to scan for short opportunities in the upcoming session. Look for entering the market short at CPR pullback.

- INSIDE: flag this field if you want to scan for breakout opportunities in the upcoming session. Look for expansion beyond previous High or Low.

- INSIDE ADV: flag this field if you want to scan for enhanced breakout opportunities in the upcoming session. Look for expansion beyond previous High or Low.

- GPZ BULL: flag this field if you want to scan for enhanced long opportunities in the upcoming session. Look for entering the market long at CPR pullback.

- GPZ BEAR: flag this field if you want to scan for enhanced short opportunities in the upcoming session. Look for entering the market short at CPR pullback.

- CHANGE BIAS LONG: flag this field if you want to scan for change of bias from short to long opportunities in the upcoming session. Look for entering the market long at CPR pullback.

- CHANGE BIAS SHORT: flag this field if you want to scan for change of bias from long to short opportunities in the upcoming session. Look for entering the market short at CPR pullback.

- NEXT CPR: always flag this field after market closure to scan for the upcoming CPR. If you scan the market after market open, un-flag the field

- PERIODS: look-back periods for average volume and average daily range settings below (60 days by default)

- VOL: set the minimum average volume of the asset over the PERIODS set above (5 Mio pieces by default)

- ADR: set the minimum average daily range (high – low of each candle) of the asset over the PERIODS set above (0.5 $ by default)

The CPR concepts have been taken from the book “Secrets of a Pivot Boss” by Frank Ochoa and made available on PRT through proprietary coding.

Please feel free to get in contact with me to deepen the trading methods behind its usage.

Reviews

There are no reviews yet.