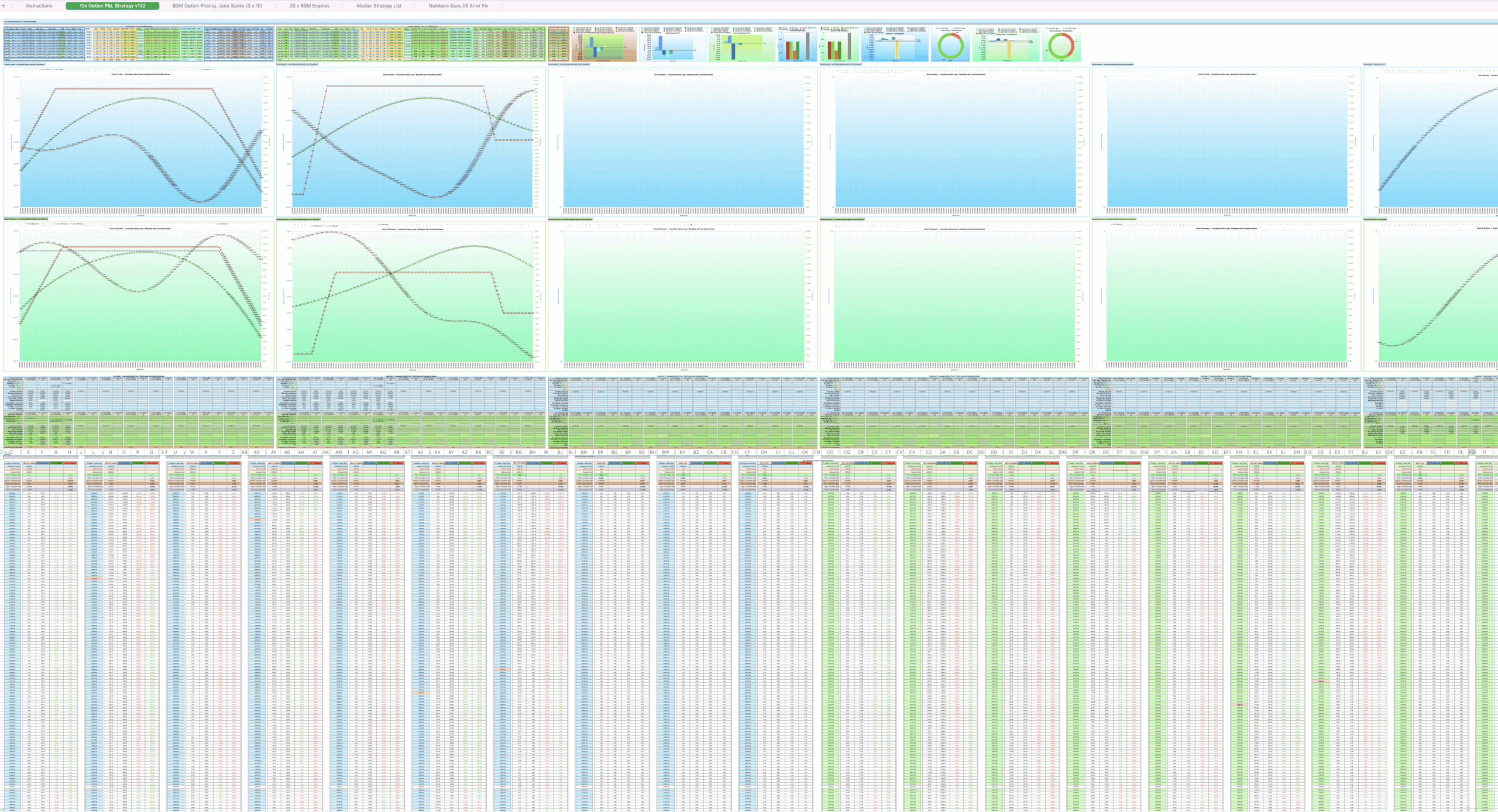

10x Leg Profit & Loss Option Master Strategiser Features:

Master Complex Options Strategies with Professional Precision

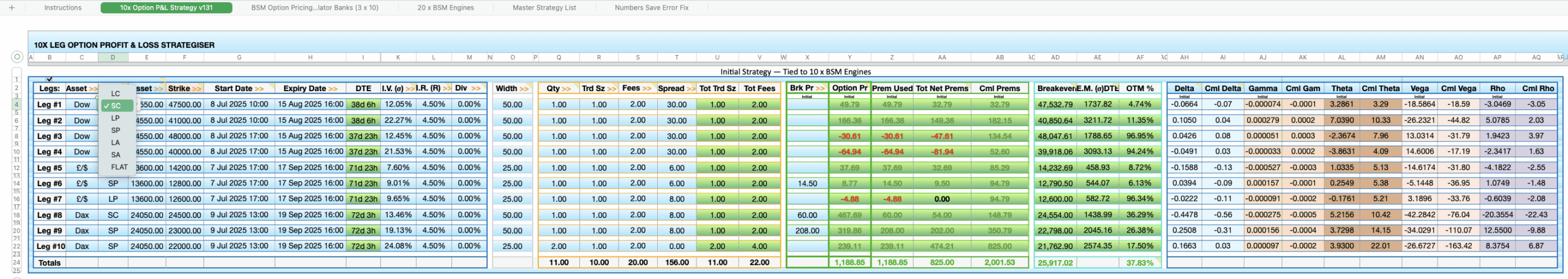

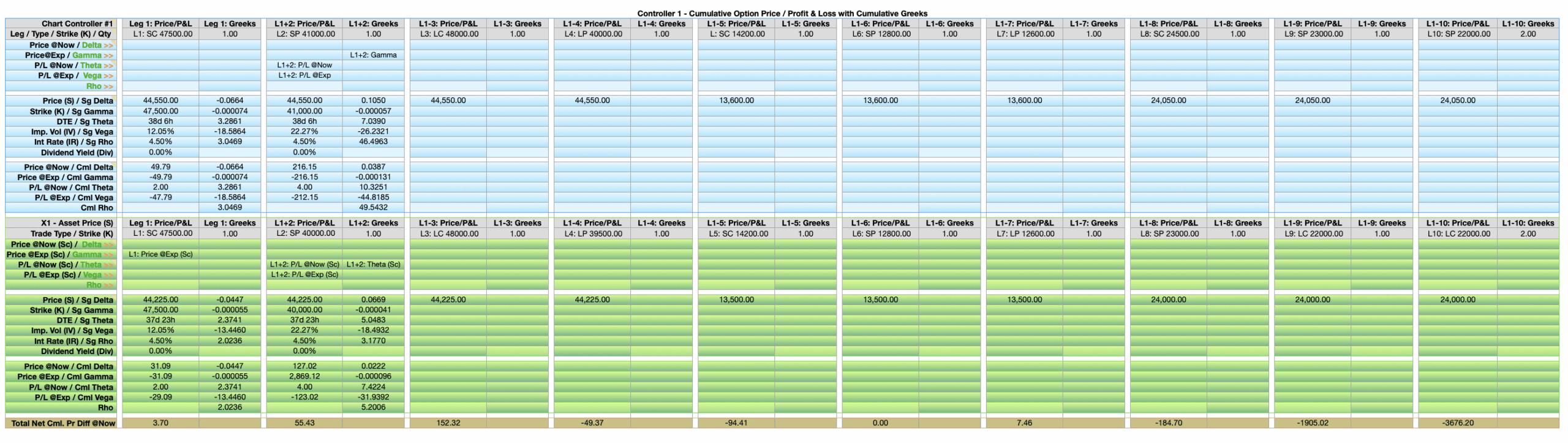

Transform your options trading with the most sophisticated multi-leg analysis tool available. Track up to 10 positions simultaneously while mastering every aspect of risk management through comprehensive Greeks analysis, precise Black-Scholes-Merton pricing, and advanced scenario planning.

Core Capabilities:

Complete Strategy Analysis:

Monitor your entire portfolio’s risk exposure and P&L across up to 10 option legs with real-time calculations of Delta, Gamma, Theta, Vega, and Rho. Each position displays individual breakeven points, expected moves, and critical metrics including OTM probability percentages — giving you complete visibility into your maximum profit and loss potential.

Advanced Scenario Planning:

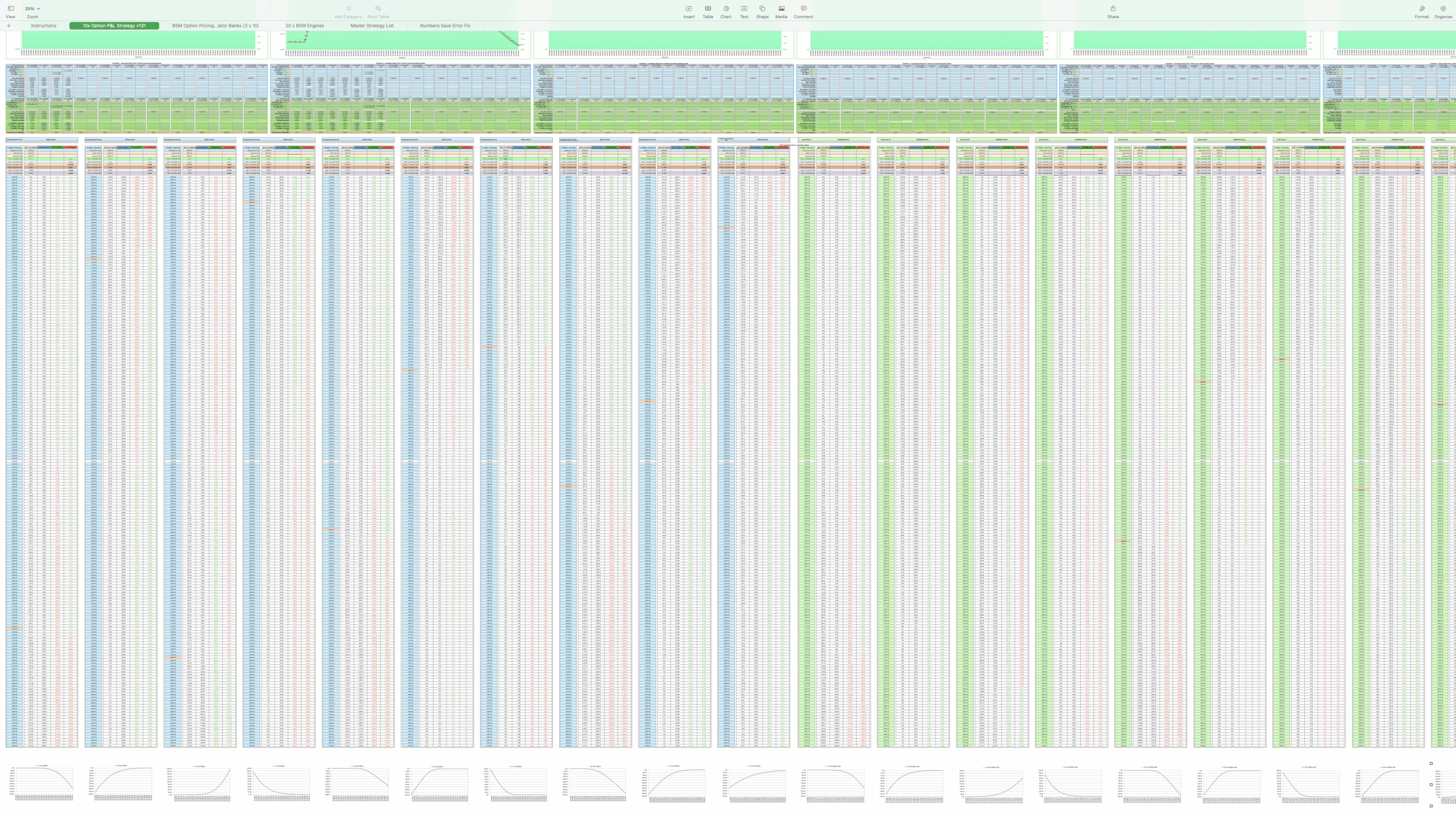

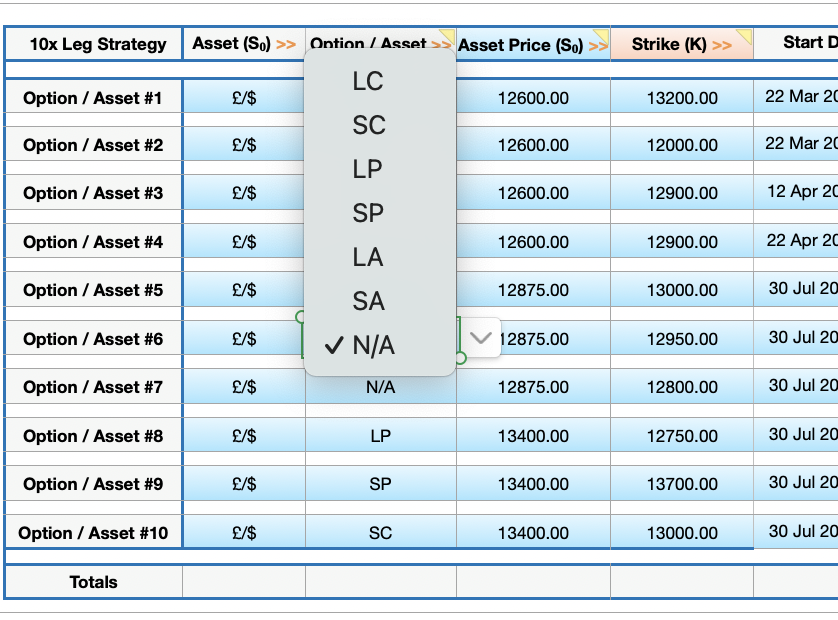

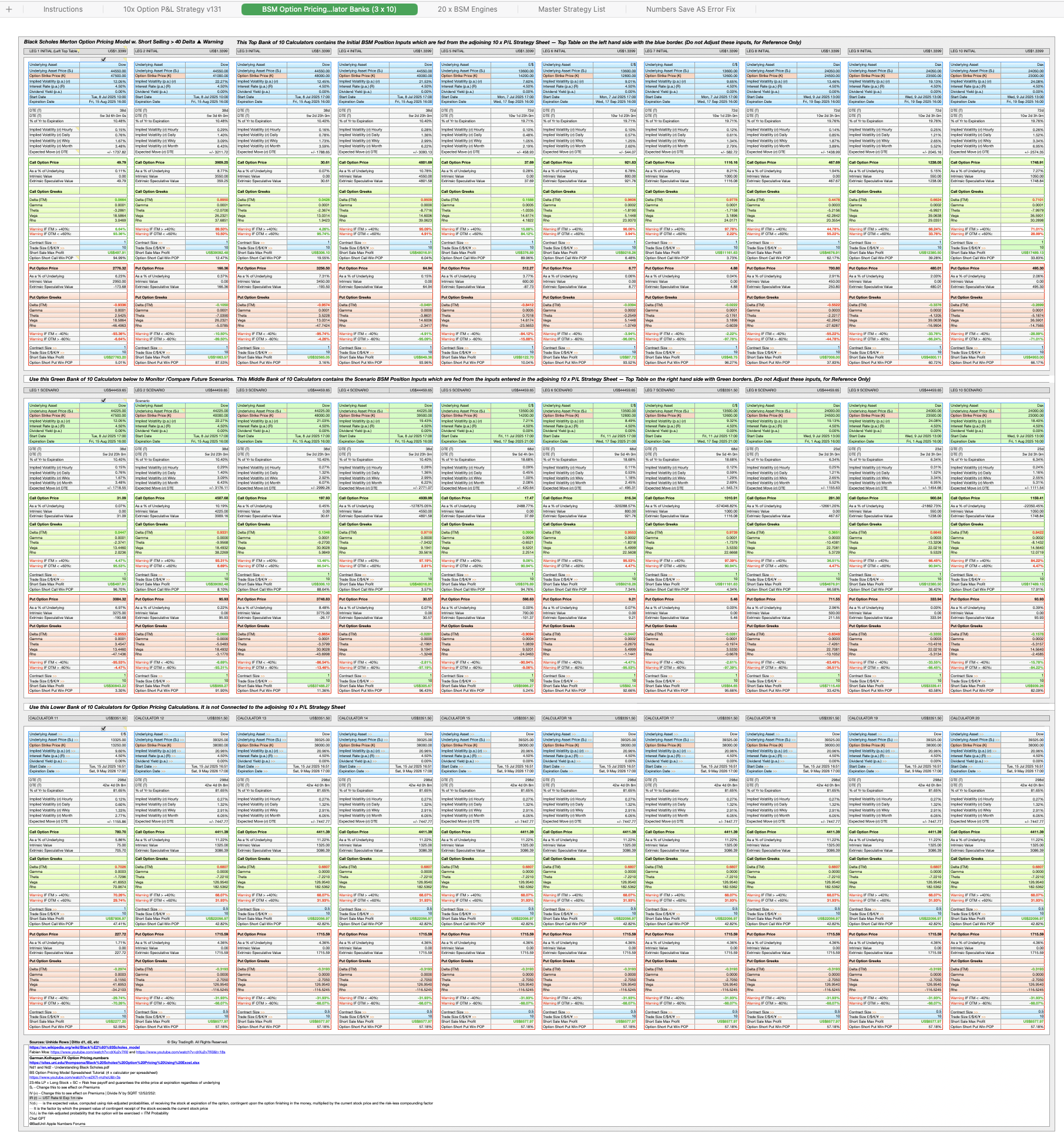

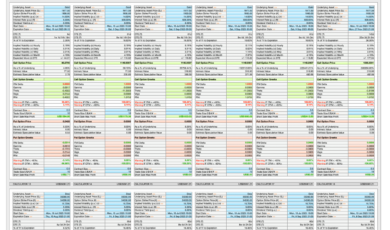

Initial Strategy (Blue Tables): Input your current strategies BSM inputs, asset prices, strikes, DTE and implied volatility. The calculator instantly displays premiums, fees and net P&L in easy-to-read green fields. Broker bid-ask spreads can also be inputted.

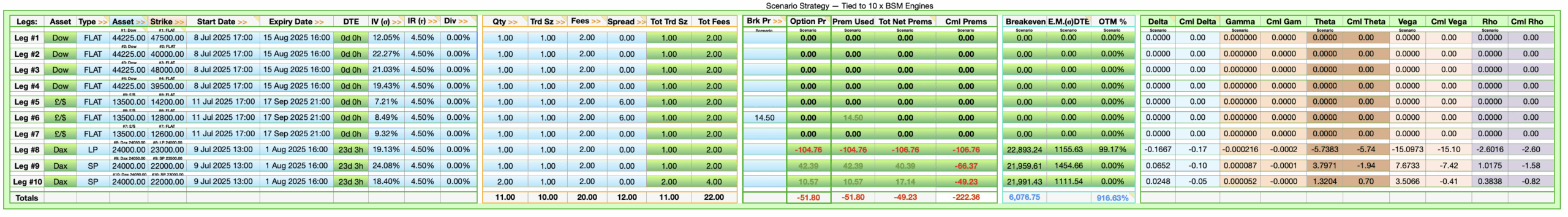

Scenario Analysis (Green Tables): Run “what-if” scenarios with the same intuitive interface. Test market crashes, volatility spikes, or strategy modifications to understand their impact on your initial positions.

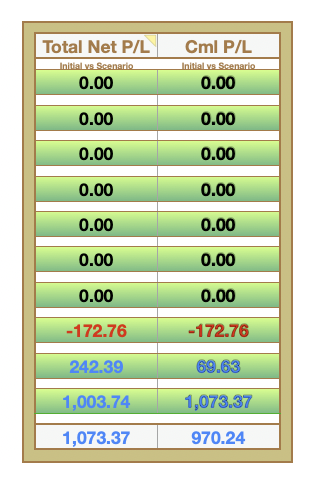

Impact Analysis (Brown Tables): See the precise difference between your initial and scenario strategies. Whether you’re testing a 10% market crash, closing losing positions, or adjusting for volatility changes — get immediate visual feedback on both charts and data tables.

Professional-Grade Features:

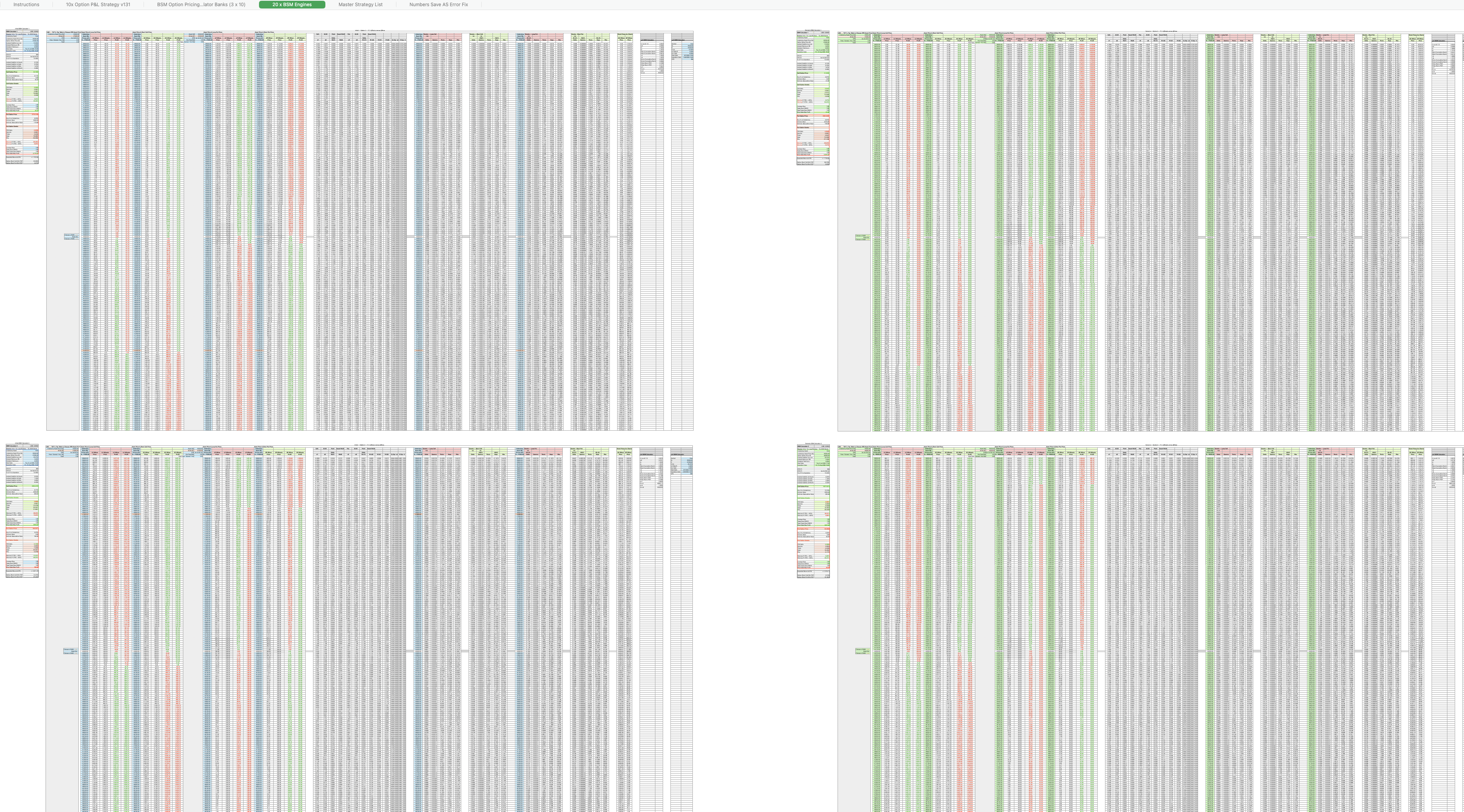

Dual BSM Engine System:

20 dedicated Black-Scholes-Merton calculators (factoring dividends) work independently for separate option legs:

- 10 BSM engines for initial strategy analysis.

- 10 BSM engines for scenario planning.

- Delivers institutional-level pricing accuracy to 2 decimal places.

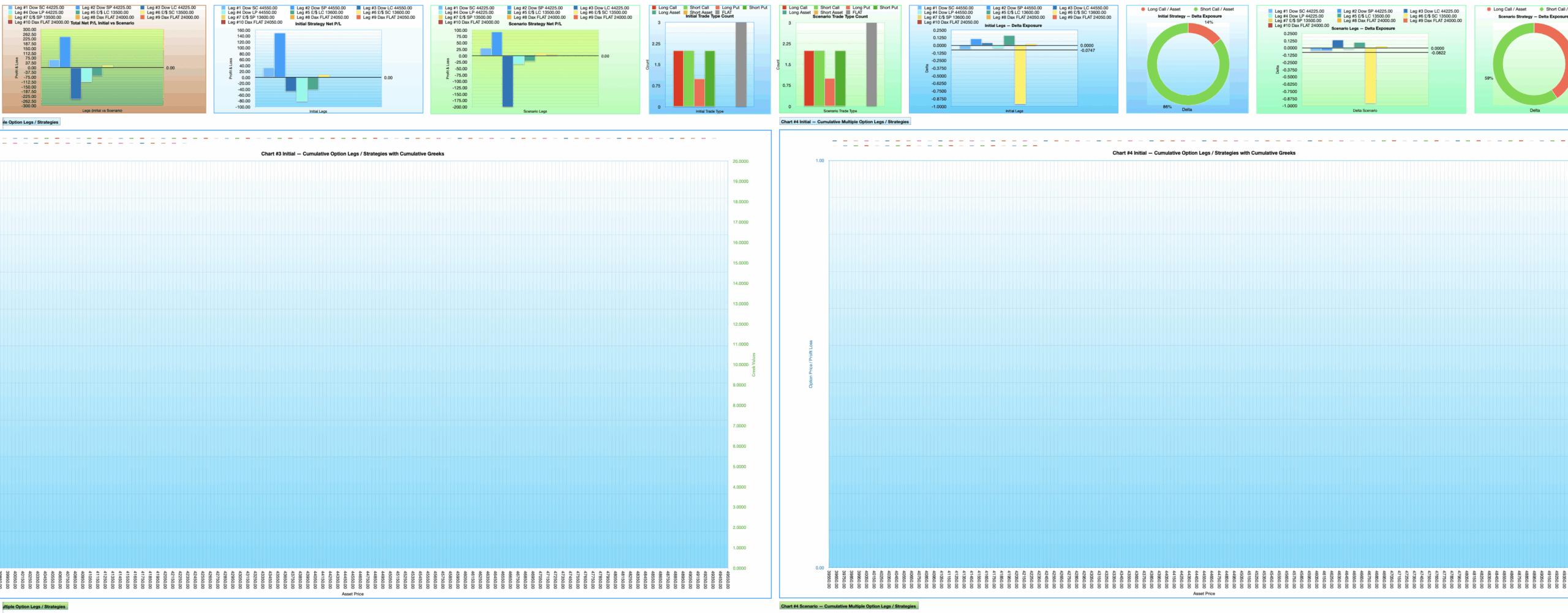

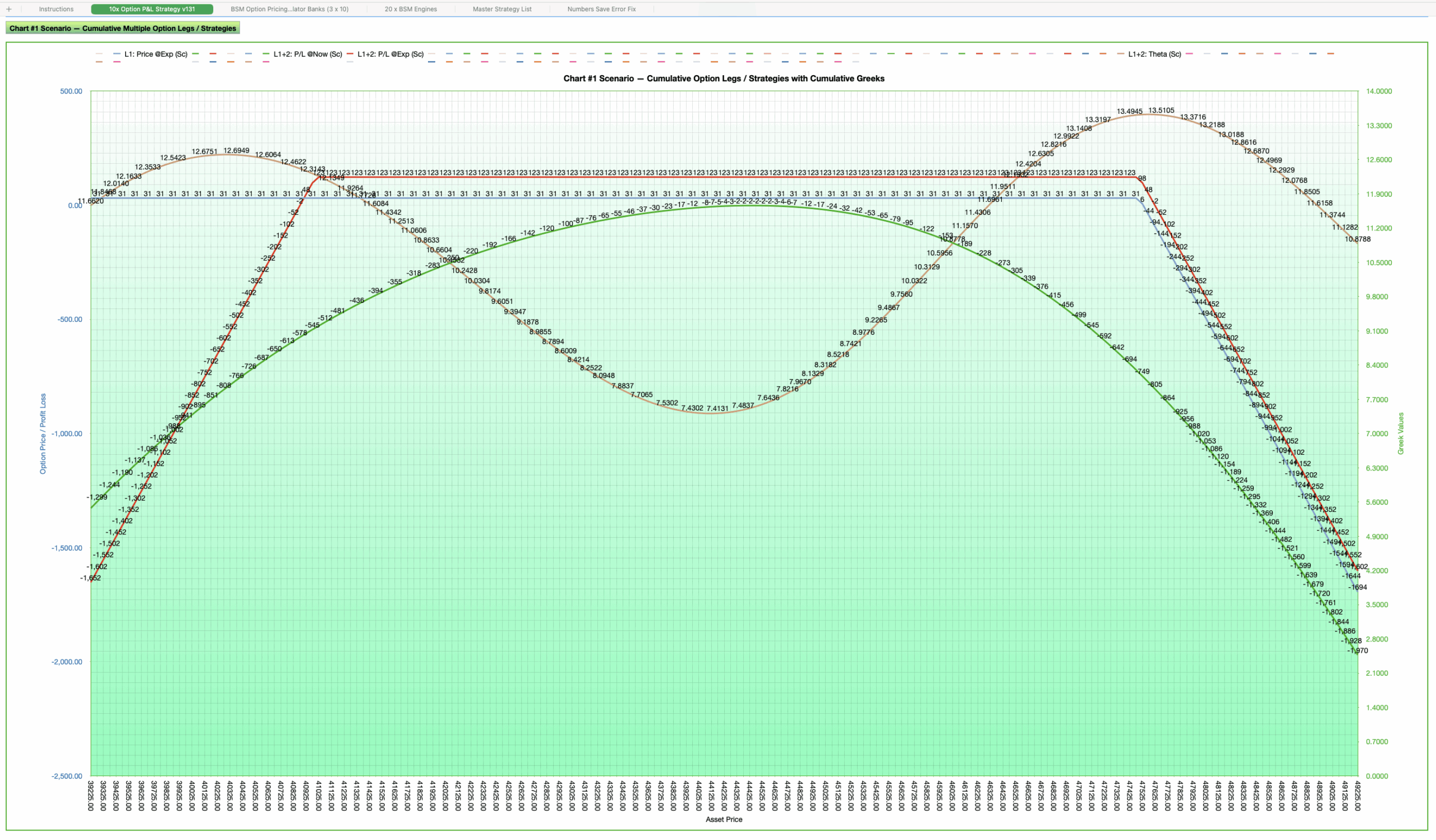

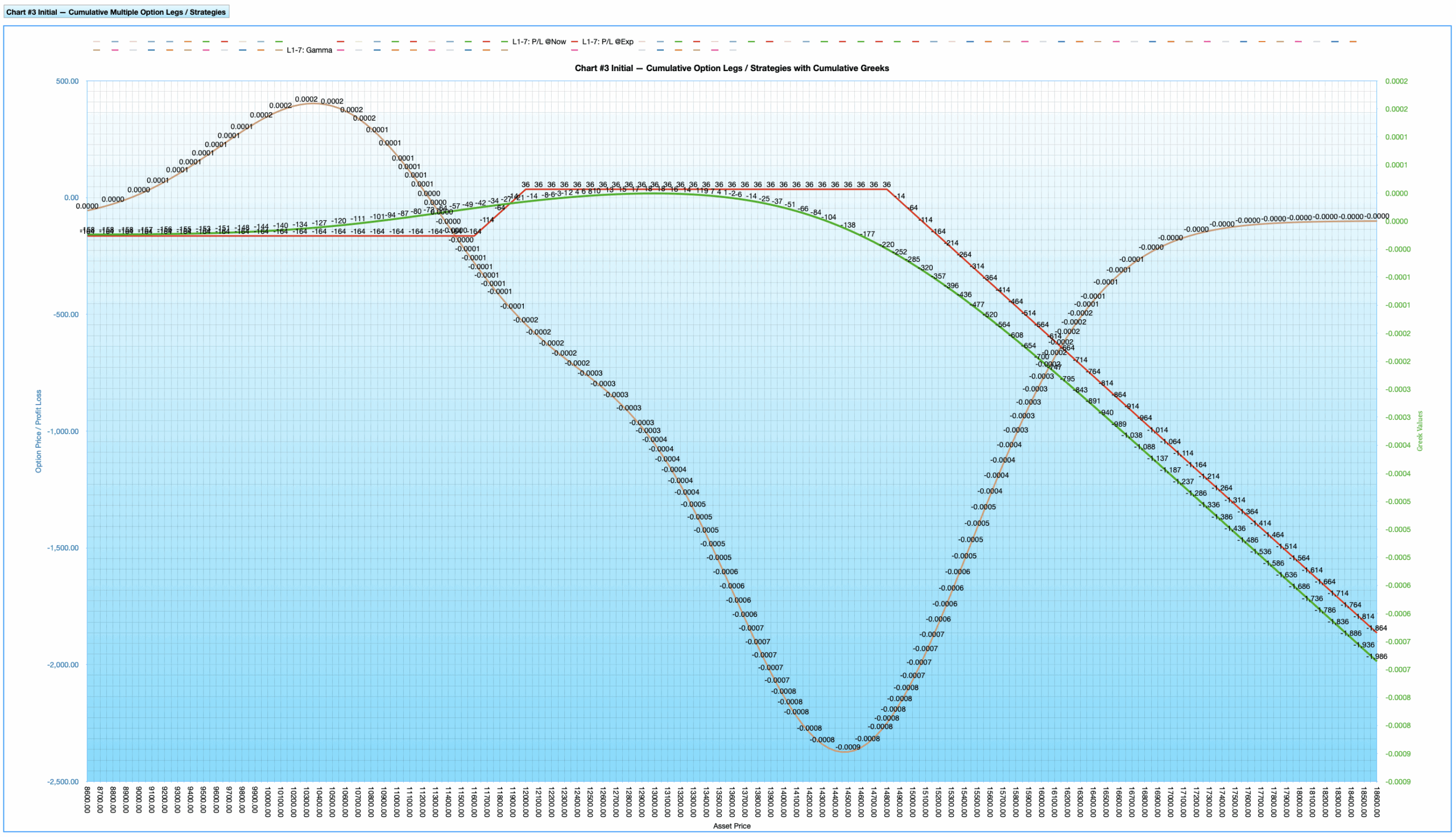

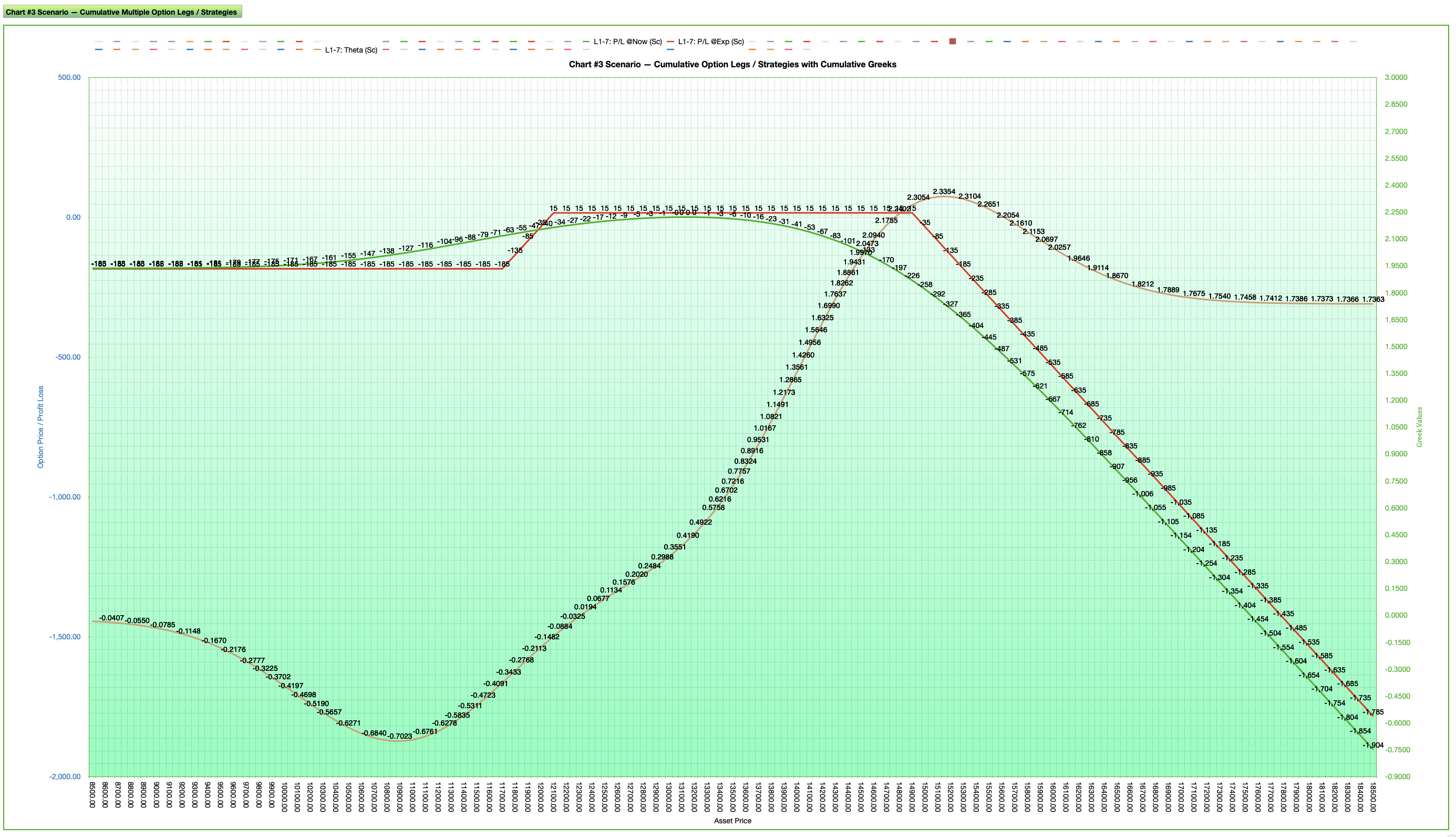

Comprehensive Visualisation:

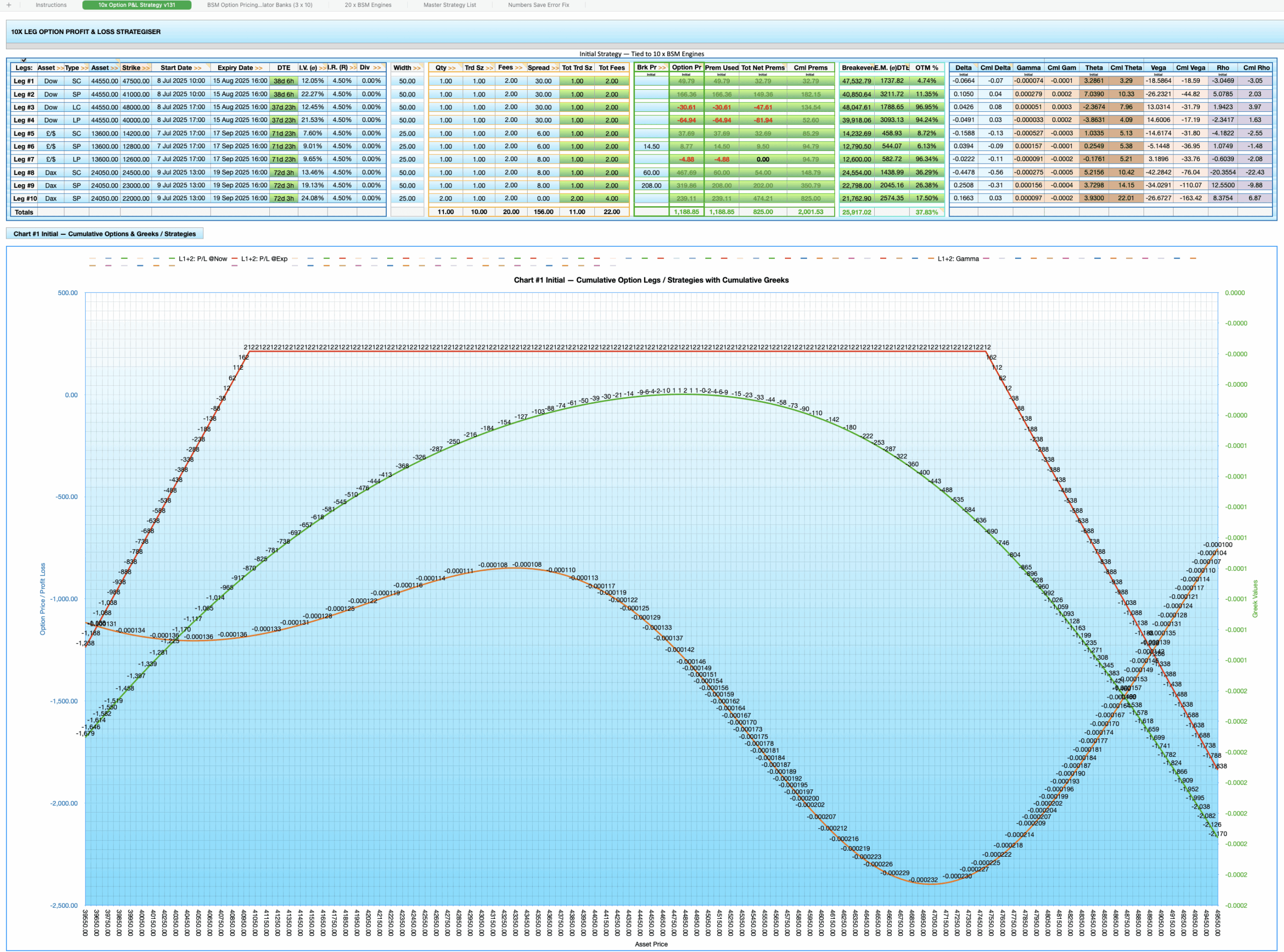

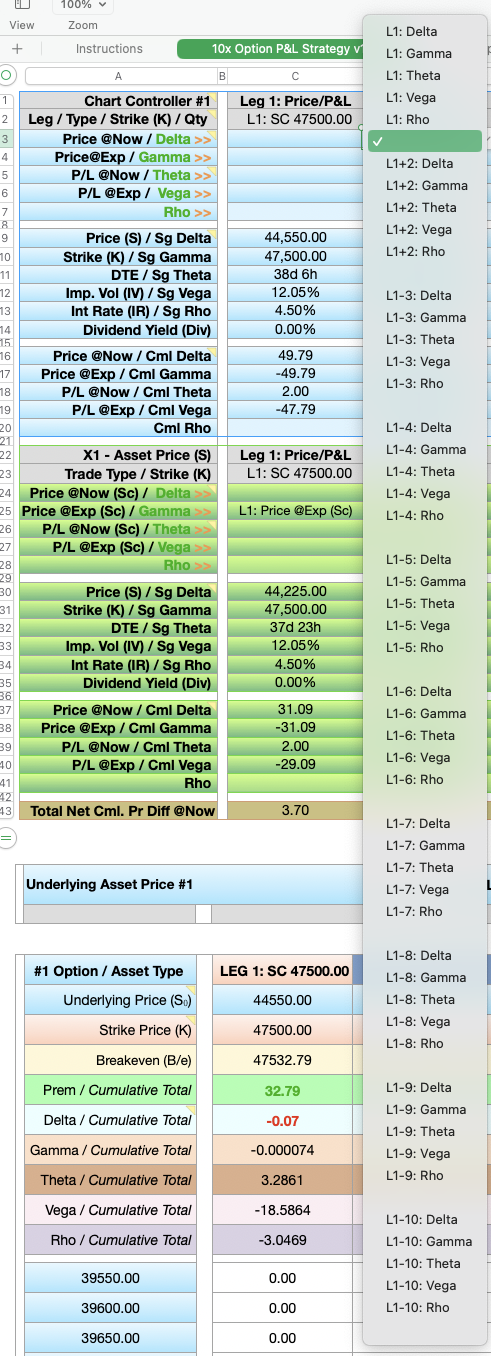

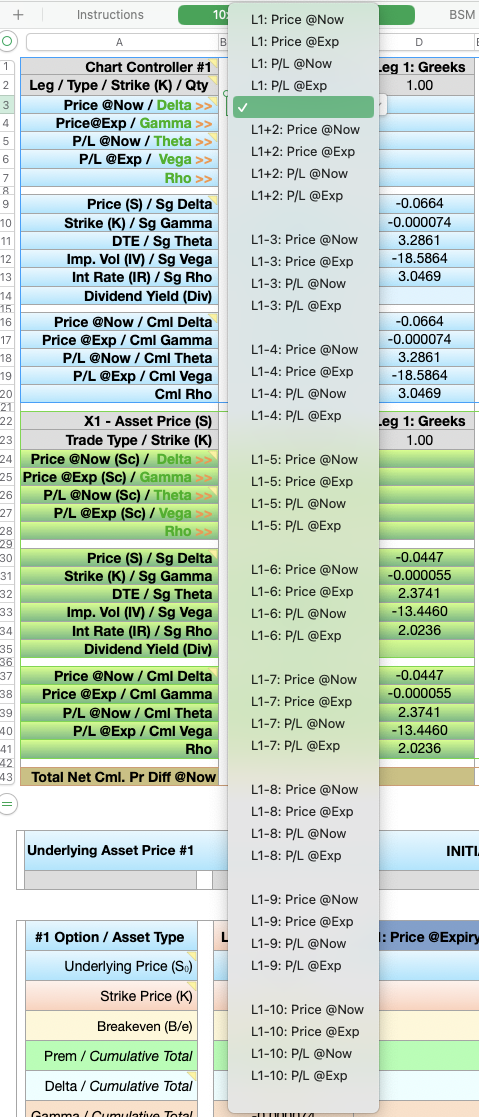

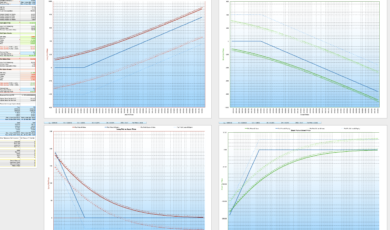

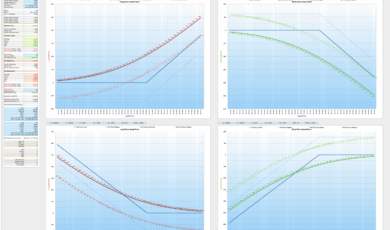

12 Independent Charts display individual and cumulative data for:

- Option prices (@Now and @Expiry)

- P&L calculations (@Now and @Expiry)

- Individual and cumulative Greeks analysis

- Long/Short positions across Calls and Puts

Blue charts display Initial Strategies, green charts Scenario “what-ifs Strategies.”

Chart Intelligence: Plot a Strangle on Chart 1, set those legs to “FLAT,” then model an Iron Condor on Chart 2 using different legs — all while maintaining your original data. Test multiple strategies simultaneously without resetting inputs.

Professional Risk Management:

Black Swan Preparation: Built for extreme market events with ultra-wide asset price ranges. Whether it’s a 50% market crash or currency crisis (like the Liz Truss’s UK pound collapse), your calculator adapts automatically.

Real-Time Monitoring: Option Start Date cells can be set to live “@Now” pricing, (computer CPU power dependent), enabling real-time option price tracking (CPU dependent). Watch your positions adjust instantly as market conditions change. Modify implied volatility (I.V.) and other variables, and witness the tables and charts adapt seamlessly. (Find the code to add to the top tables in the separate 30x BSM sheet tab).

Broker Verification: Compare BSM calculations with actual broker pricing to identify over / under-priced options. Manually input broker premiums when they differ from theoretical values.

Advanced Analytics:

Market Intelligence:

- Implied Volatility Projections: Market move insights across minute, hourly, daily, weekly, and monthly timeframes.

- Expected Move Calculations: Determine precise market movement expectations down to the minute.

- POP (Probability of Profit): Individual probability calculations for Short Calls and Puts across any timeframe.

Precision Timing:

- 0 DTE Calculations: Handle “zero days to expiry” options right down to final minutes before expiration.

- Greek Targeting: Select optimal strike prices based on Delta probabilities.

- Wide Asset Coverage: From forex pairs like GBP/USD to major indices like S&P 500.

Flexible Configuration:

Customisable Asset Width: Adjust tick increments to match your trading style:

- 5-tick increments for precise analysis.

- 50-point increments for broad market coverage.

- Automatic scaling for any underlying asset.

Chart Controllers: Simple dropdown menus for instant metric selection and plotting across all 12 charts.

Built for Professional Traders:

Transparency & Control:

- No hidden or locked tables—complete visibility into all calculations.

- Fully customisable for your specific needs.

- Comprehensive documentation and embedded explanations.

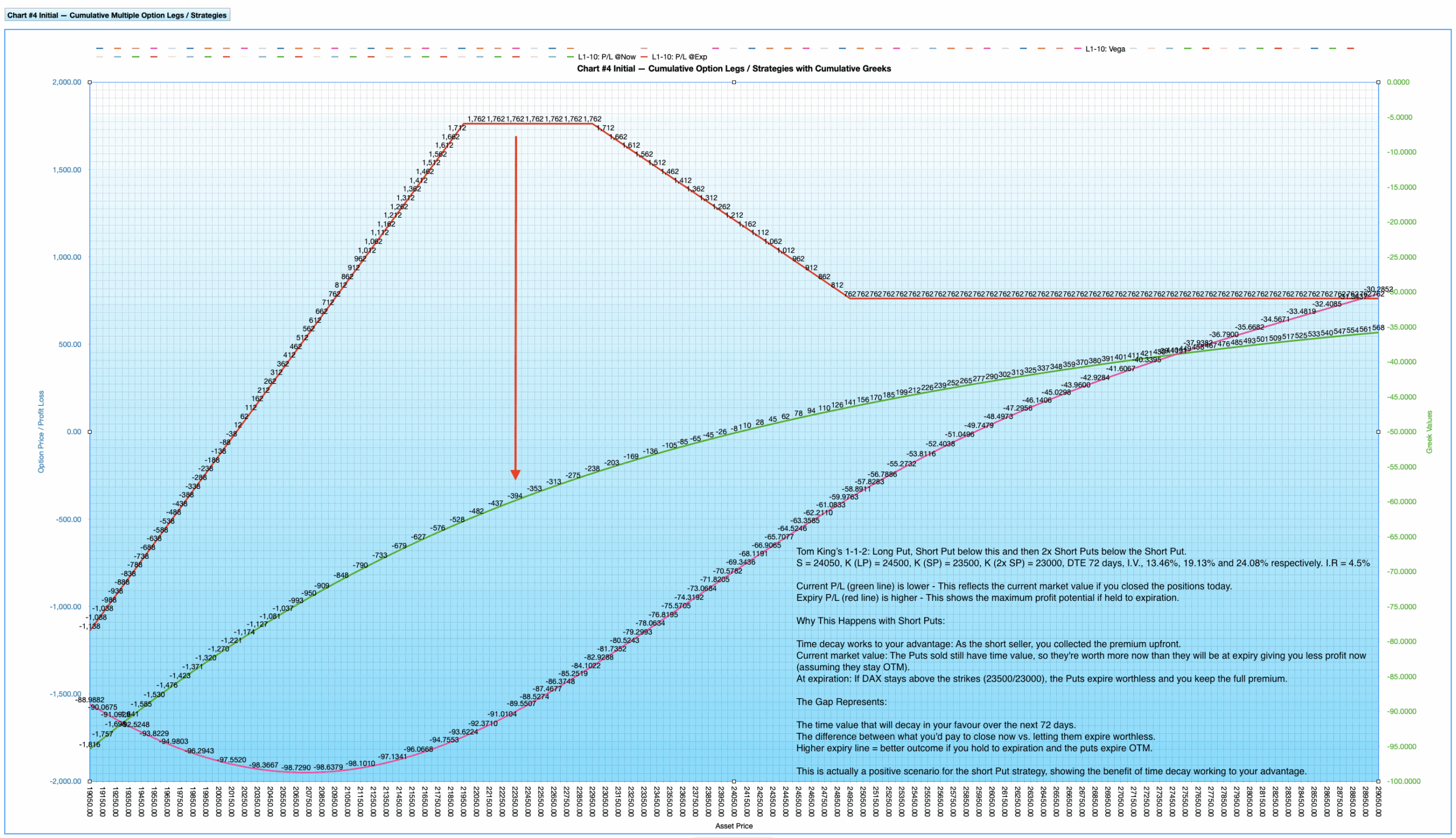

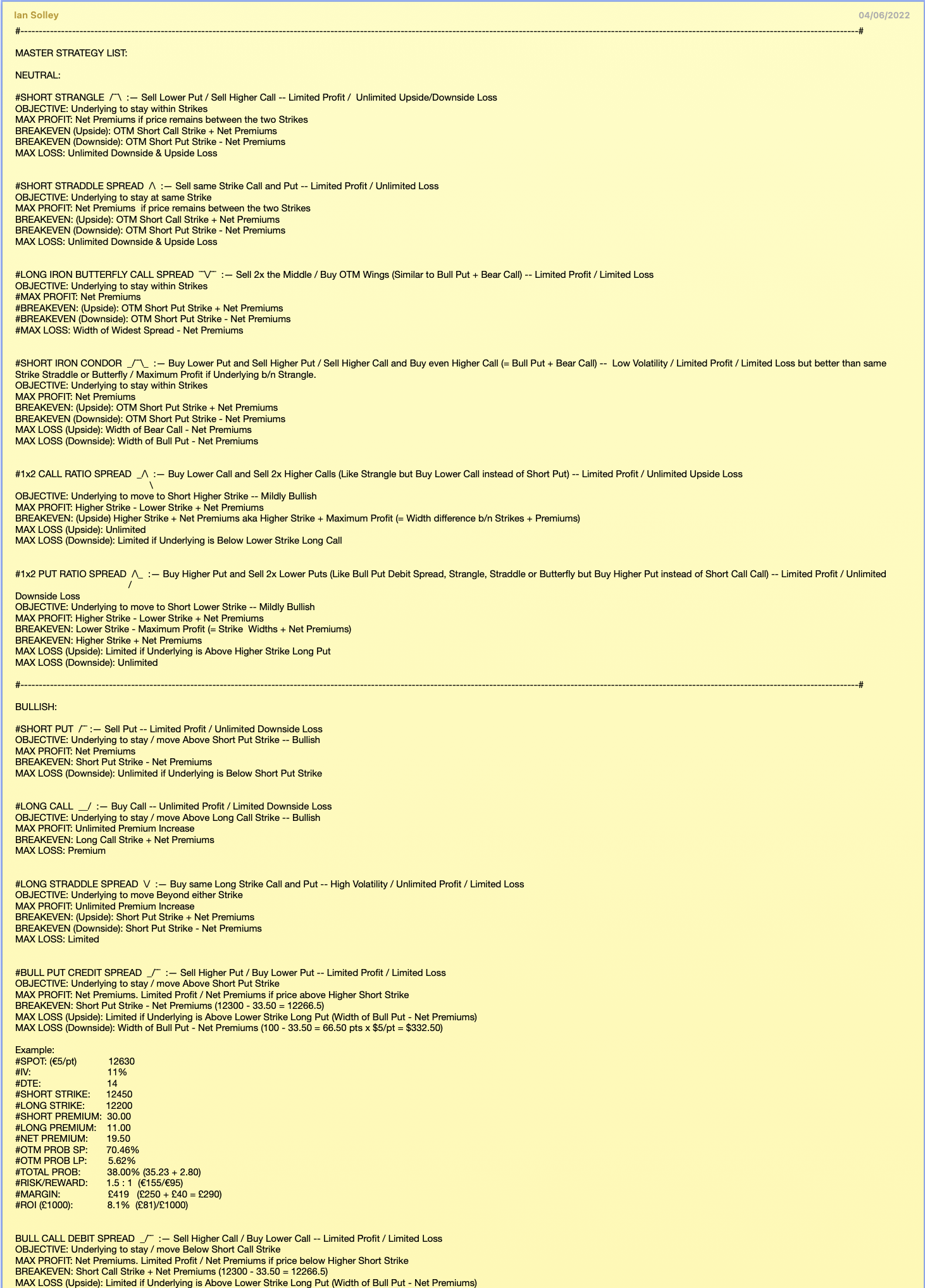

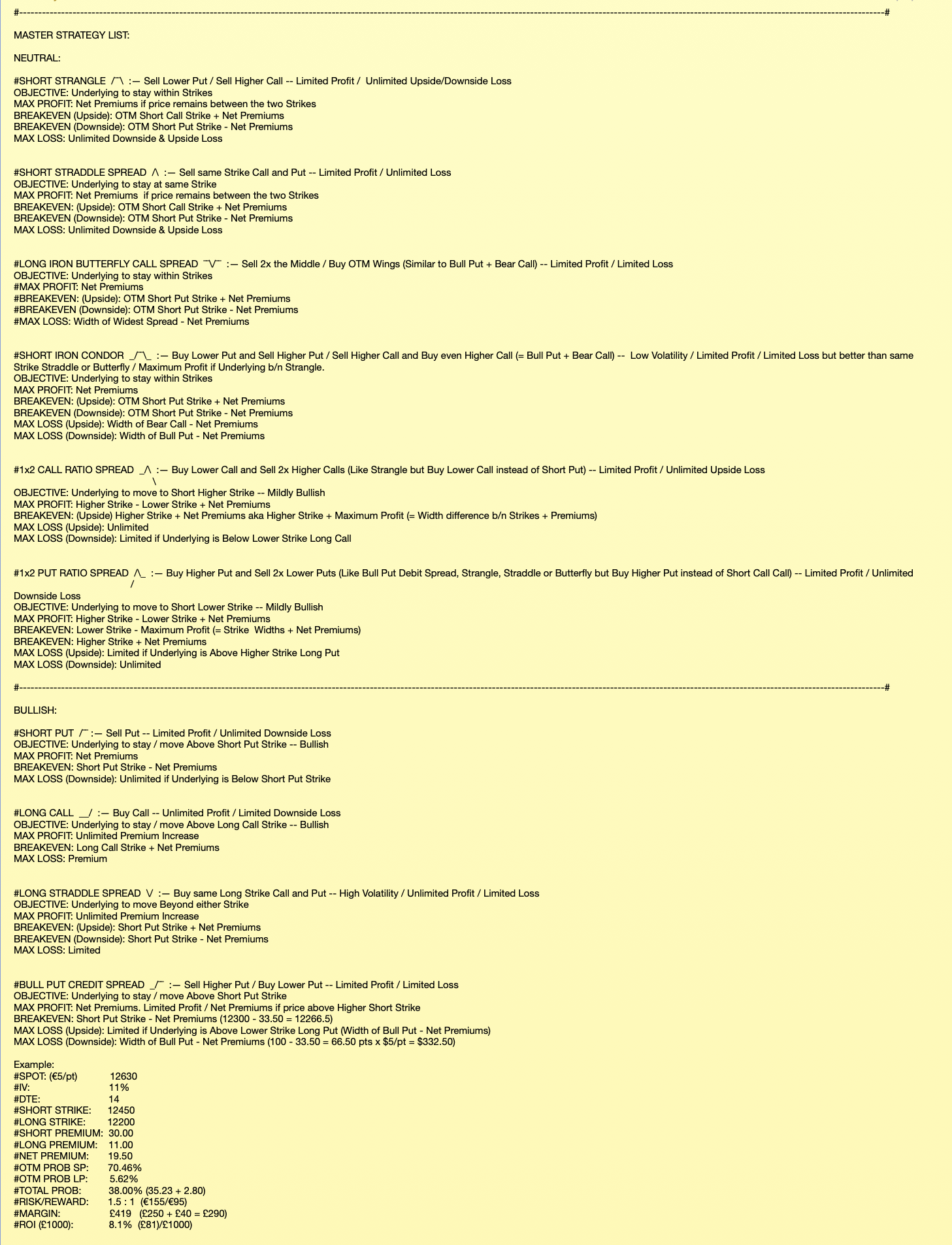

Multi-Strategy Capability:

Model complex strategies like:

- Iron Condors across multiple charts.

- Jade Lizards with cumulative P&L tracking.

- Tom King 1-1-2 strategies.

- Custom combinations limited only by your imagination.

Crisis-Tested Reliability:

Designed specifically for volatile markets and extreme events. When others fail during market stress, your calculator continues delivering accurate analysis — whether it’s a 500-point index move or a 11-cent currency crash.

Your Complete Trading Edge:

In today’s volatile markets, professional traders need professional tools. The 10x Option Master Strategiser doesn’t just calculate — it anticipates, analyses, and adapts to any market condition.

Stop trading blind. Start trading with precision.

Developed by Ian ,B.Sc. Finance (Hons) | 2.5 years of development and refinement | Zero competition.

Ready to transform your options trading?

Download the 10x Option Master Strategiser and take control of your market risk today.

Please Note: All my calculators have unique embedded Serial Numbers to protect my copyright and limit file sharing.

Bewertungen

Es gibt noch keine Bewertungen.